2019 Wrap Up

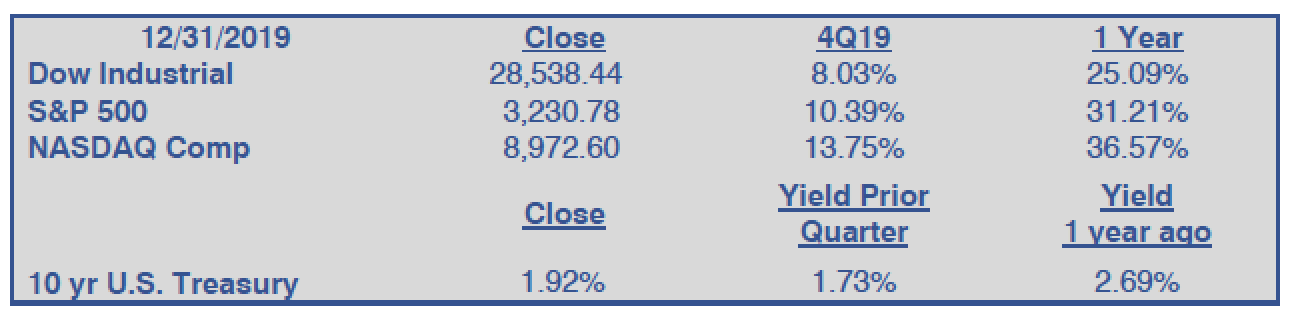

In 2019, we saw stocks and bonds stage an extraordinary run with the S&P 500 having its best year since 1997. Together, stocks and bonds had their biggest simultaneous gains in more than two decades. The market was up slightly more than 30% with the Information Technology sector showing an enormous rebound from its 4Q2019 meltdown as the sector surged by more than 50% for the year. Even the market’s laggard, the Energy sector, showed an increase of more than 11%. Abundant new oil production due to shale fracking, combined with climate concerns continues to act as a drag on the sector. Even international turbulence, such as the Iranian bombing of Saudi Arabia’s primary export terminal, was shrugged off by energy traders.

Looking at fixed income, the 10-year U.S. Treasury yield, whose yield falls when bond prices rise, fell sharply during the year and approached an all-time low before closing the year at a 1.92% yield, down 20% from the year’s start. In contrast, last year the Federal Reserve reduced rates three times to proactively address growth concerns primarily generated by the ongoing U.S. trade wars with most of its trading partners. At the recent Federal Reserve Open Market Committee (FOMC) meeting, the Fed maintained its current overnight interest rate between 1.50% and 1.75% and expressed that it expects the economy to continue to improve although concerns remain over the muted continued inflationary pressures. Effectively, the Fed decided to leave unchanged its current interest rate stature pending further data.

MOVING FORWARD

The markets, and most economies, breathed a sigh of relief when the Trump Administration and the Chinese government signed a Phase 1 trade deal at the start of 2020 where China committed to buying more U.S. goods. While not a resolution of the U.S.’s ongoing pushback regarding long-standing trade imbalances, the move represented a reduction of trade tensions which was well received by both investors and economists. Considering this recent de-escalation of tensions between the U.S. and China, and in concert with last year’s monetary easing by many central banks, the International Monetary Fund recently raised its projection on global growth to 3.3% for 2020. This followed a year where the global economy notched its weakest growth since the Financial Crisis at only 2.9%.

On the home front, the final reading for U.S. 3rd quarter GDP was 2.1%, a modest improvement from original estimates of 2.0%. In the face of weak manufacturing performance, much attention has recently been placed on consumer spending which represents more than 2/3 of U.S. overall economic activity. While unemployment has remained at record lows of 3.5%, actual year-over-year growth in nonfarm payrolls has dropped to its lowest level in more than 2 years. Of added concern, the year-over-year growth in average hourly earnings (i.e. the ratio of total pay to total hours worked) has fallen to 1.1% from 1.6%. This is the math behind the furrowed brows of many economists.

As for Wall Street, following its 30+% gain last year, market expectations for 2020 are far more muted. The VIX, also known as the market’s fear indicator, fell by 50% in 2019 ¬its biggest annual fall on record. At its current historic lows, the fear indicator currently reflects a great deal of complacency on behalf of investors. In fact, some have already started positioning for more turbulence as the U.S. presidential race heats up because historically there is an increase in volatility in election years.

Overall, the data point to a better trajectory for the global economy than in recent quarters; however, stocks last year priced in much of this anticipated improvement following the central bank’s widespread monetary stimulus. This could well mean weaker global stock market performance in 2020 than in 2019 despite a better overall economy. Can the markets go higher from here? Absolutely, however, it is not clear the anticipated modest corporate earnings growth will provide enough impetus for appreciable additional market upside. After the U.S. markets’ 10+ year run, investors should ensure they have the ability to absorb risk in their own portfolios and that their portfolio is appropriately aligned with their long-term needs. If you have any concerns regarding your specific situation, please do not hesitate to reach out to us at (504) 521-7350.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |