First Quarter Wrap Up

As we started 2020, the prognosis for the global economy was solid. Little noticed though was news reports starting to come out of the Chinese city of Wuhan about a new flu-like disease. Oh, how the world has changed in a mere 3 months….

The United States has become the epicenter of the global pandemic of the re-named COVID-19 disease with more than 670,000 confirmed cases and more than 33,000 deaths. Domestically, millions of Americans, especially in the lodging, travel and restaurant industries, have unexpectedly become unemployed as companies both big and small struggle to remain in business as demand for their services has evaporated. In short order, the world’s economy has come to a screeching halt in a mere matter of weeks. As the year started, the International Monetary Fund was projecting a fairly robust global growth rate for 2020 of 3.3%. The IMF is now projecting global economic activity to shrink by at least 3% this year, the sharpest global economic contraction since the Great Depression. The lost economic activity is estimated to be at least 9 trillion dollars – equivalent to the total annual economic production of both Japan and Germany combined.

Moreover, the IMF’s projections could well be optimistic as they assume that COVID-19 will neither linger nor return. Usually the most conservative of financial institutions, the IMF is now urging policymakers to avoid repeating the Depression-era mistake of ratcheting back budget deficits as the situation starts to improve. Instead, the Fund is urging governments to ramp up fiscal stimulus even further when the contagion starts to abate.

Since the stay-at-home instructions started to be issued in the U.S. in late March, the unemployment rate has shot up to 4.4 percent from the near-record lows of 3.5 percent seen in February. That is a remarkably sharp rise but one that is shortly going to be massively revised upwards. New weekly unemployment claims have gone up at a record rate in the last several weeks with more than 22 million new claims filed, obliterating almost all of the jobs created in the 11 years since the end of the Financial Crisis. To put these figures in perspective, the prior record weekly unemployment record was less than 700,000. In comparison, the average number of unemployment claims has exceeded 5.5 million/week over the last month. Economists are currently estimating that the U.S.’s gross domestic product will shrink by a minimum of 15% for the 2nd quarter and potentially by as much as 35%, a level heretofore never imagined possible.

Moving forward, our country’s leaders and medical experts are struggling to figure out when and how to ease up on the current stay-at-home mandates prevailing across the country. Never has the world seen such a rapid and overwhelming decline in economic activity; however, governments and central banks worldwide have responded with exceptional speed and action. In the U.S., the Federal Reserve has effectively committed to doing anything necessary to maintain the flow of credit. The U.S. central bank has even taken the extraordinary and unprecedented action of buying the commercial debt of previously investment-quality-rated companies to ensure market liquidity.

On the fiscal side, Congress has rolled out an economic stimulus package to combat the effect of the nation’s shutdown by approving more than $2.0 trillion of extraordinary outlays. To put this figure in better perspective, the TARP program, which helped save the financial system during the Great Recession of 2008/2009, was only $800 billion in comparison. Already, U.S. lawmakers are wrangling over a second round of fiscal stimulus with Republicans pushing for a bare-bones program to exclusively fund the remaining unfunded new small business loan program with Democrats pressing for a larger second round of fiscal stimulus.

To make recent matters worse, an oil price war started in early March as Saudi Arabia and Russia both decided to defend aggressively their market shares. The immediate result of the oil demand/supply imbalance was the sharpest decline of energy prices on record as oil declined by more than 50% in a matter of days. While the two parties recently came to an agreement to reduce production by 10%, in the intervening weeks global oil demand has collapsed by more than 25%. This has caused oil prices to decline beneath $20/barrel for the first time in more than 20 years.

MARKETS

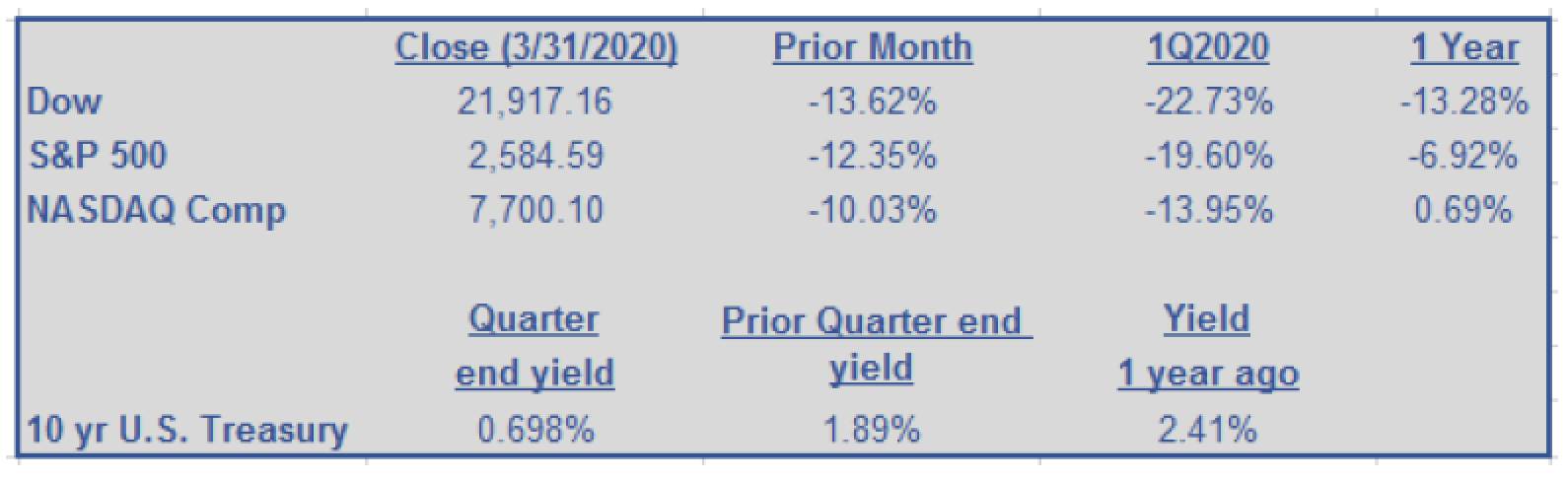

It will come as no surprise to learn that the worst-performing stock sector in the year’s first quarter was Energy with a 50.5% decline. Even the market’s best-performing stock sector, Information Technology, suffered a decline of almost 12% for the period. On balance, Wall Street saw a decline of almost 20% for the quarter and this dismal result only occurred after the market rallied back sharply from a 35%+ decline achieved in mid-March. Clearly, an enormous change in investor perspective has occurred since February when Wall Street was still regularly achieving record highs.

Concurrently with the extreme turmoil in global stock markets, there was a flight to safety with the yield on the 10-year U.S. Treasury closing the quarter yielding a minuscule 0.7% after plunging to a record low of 0.4%, and down severely from its year opening yield of almost 2.0%. In the meantime, the market’s so-called fear gauge (the VIX) has gone through the roof in recent weeks. After starting the year at a historically low level of 13.5, the reading by mid-March climbed more than 525%, almost equal to the worst levels briefly seen during the Financial Crisis. More importantly, the fear gauge for more than 6 weeks has remained at severely elevated levels with daily market moves of 4+% becoming commonplace.

WHERE DO WE GO FROM HERE?

Although tentative, it is possible that the market has hit its peak pessimism as Wall Street has rallied more than 18% from its March lows. Analysts and companies have largely given up even attempting to project potential corporate earnings for the next several quarters. Rather, experts are now largely focusing on estimating earnings in 2021 and beyond by which stage it is believed that the consequences of COVID and the related global shutdown will have started to abate. The market’s recent behavior seems to suggest that more bad news will not be enough to get investors appreciably more nervous than they already have been. In response to this unique economic collapse, how should individual investors respond? Unless your personal situation has sharply changed, we believe that no precipitous action of any kind remains the most prudent course.

To put the current situation more in perspective, and while the market’s recent downturn has been quite painful, Wall Street is now at levels seen as recently as the Spring of 2019, just a mere year ago. Notwithstanding the first quarter’s turmoil, long-term investors are still showing substantial gains from the bull market that started in March 2009. It is times such as this that investors have to suffer through in exchange for the robust market advances of the prior 11 years.

In any case, if you would like to talk, please do not hesitate to reach out to us at (504) 521-7350 – we remain available at your convenience. All of us at Dumaine hope that this letter finds each of you safe and healthy during these trying times.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |