Second Quarter 2020 Wrap Up

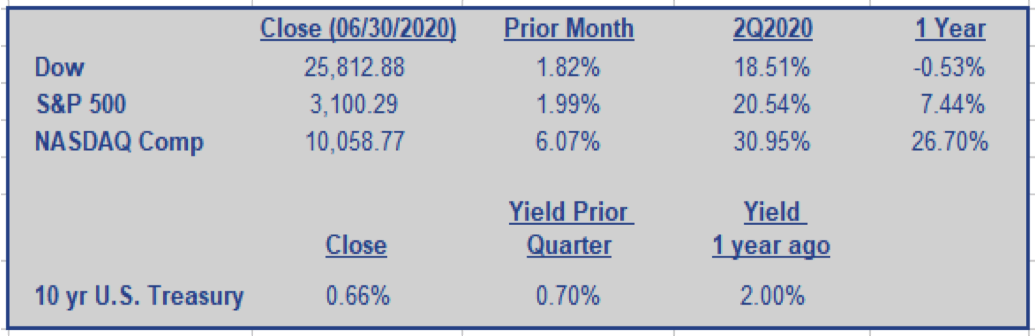

To the surprise of almost everyone, especially as it occurred in the face of a global pandemic which in turn drove a global economic lockdown, the S&P 500 produced its best quarterly return since the 4th quarter of 1987 with a gain of 20.5%. This astounding performance came in the face of U.S. unemployment climbing by an unprecedented 11 percentage points in less than 6 weeks as 30 million Americans became immediately and unexpectedly unemployed as state and local governments shutdown local economies in an effort to rein in the rapidly spreading COVID-19 pandemic. Fortunately, the Federal government and the U.S. central bank both responded quickly and decisively to mitigate the quarter’s staggering economic decline as the U.S. GDP shrunk by an estimated 40% year-over-year.

With three economic stimulus relief bills, the federal government has now committed more than $2.5 trillion to support small businesses and to greatly increase unemployment benefits. On a global basis, the best estimate of 2020’s growth is that the world’s economic activity will decline by more than 5%. By happenstance, the best estimates for the U.S. reflect the expectation of a similar decline for the full year’s economic production – in both cases, these are declines never seen before in modern economic times.

Meanwhile, the U.S. Federal Reserve moved quickly in early Spring to slash overnight interest rates to 0.0% and committed to effectively doing anything necessary to support the U.S. economy and the nation’s businesses. The bank’s most unprecedented move included buying private companies’ debt for the first time ever and providing close to $1.0 trillion dollars to the overnight bond market to ensure market liquidity which had started to fail. In a matter of only 3 months, the Federal Reserve has expanded its balance sheet by more than 80%, or $3 trillion, as it has aggressively provided support to all areas of the U.S. banking and financial system.

The Spring and early Summer of 2020 have truly been a tale of two seasons. While unemployment has gone up at previously unimaginable rates, lower income earners are making and saving sharply higher amounts of money due to a $600/week bonus unemployment approved as part of the initial stimulus bill – these extra payments are to be paid through the end of July. In the same vein, the financial markets have been remarkably divided. Were it not for the FAANG stocks (Facebook, Apple, Amazon, Netflix, Google, and Microsoft), the broader market would be off close to 10% year-to-date. Instead, these several companies have flourished in the new world of a U.S. economy locked down with a large portion of the nation now working remotely. Outside of a few healthcare firms, the rest of Wall Street remains appreciably off from New Year’s 2020 stock prices. These two different stories are highlighted as we look at the market’s different sectors where the Information Technology sector has flourished and gained more than 14% year-to-date while the worst performing sector, Energy, showed staggering losses of more than 37% as a result of a massive global oversupply coupled with sharply reduced energy demand. A sector performance differential of such magnitude, especially in such a brief period, is completely unprecedented.

In total, only 3 sectors of the S&P 500 have showed gains for the year: Information Technology (AAPL & MSFT), Consumer Discretionary (AMZN), and Communication Services (GOOG & FB). The small FAANG group of growth stocks has been almost the sole bright spot in the market’s recent performance. As one investor stated “tech has been viewed as a defensive area for investors” but these FAANG stocks are currently trading at astronomical levels, more than 46 times their trailing earnings. For those of us who have been investors for a while, these stock valuations bring to memory the early 2000s Internet Bubble.

With the broader stock market having largely returned to break-even levels year-to-date, and again solely as a courtesy of our sharp-toothed FAANG friends, the yields on U.S. Treasuries are suggesting a very different storyline. As we go to press, 10-year yields have fallen to 0.60% as compared to 2.10% a year ago. Although the stock market is suggesting that the economy will make it through the current pandemic relatively quickly, the bond markets are singing a vastly different tune as underscored by 30-year mortgage rates hitting records lows of sub 3.0% in recent days. This dichotomy is appreciably accentuated as the historically low-interest rates encourage investors to seek higher returns, at greater risk, by investing more in riskier assets such as stocks.

Throughout the recent quarter’s turmoil, we at Dumaine Investments have held to our long-time discipline of making investment decisions consistent with our clients’ existing investment strategies. As a result, we have stayed the course and continue to opportunistically buy securities that we feel to be undervalued. To broadly sell stocks during this crisis as many have encouraged would be attempting to time the market. However, successful market timing is remarkably difficult as effectively no one anticipated the market’s sharp February/March decline. In turn, almost all were equally shocked by the incredibly strong market advance that quickly followed despite the ongoing drumroll of negative news regarding the economic and health consequences of the worsening global pandemic.

After abating for several weeks, the U.S.’s COVID case count has sharply accelerated as the virus has become more widely spread across the United States with daily new cases now exceeding 75,000 – far and away the highest level in the world. Before its imminent summer break, Congress is now focused on hammering out yet another COVID-relief bill. With nearly $2.5 trillion having already been allocated in the previous relief packages, the nation’s legislature is debating various stimulus packages whose costs range from a mere $1 trillion to as much as $3.4 trillion. Already in only 9 months, the federal government has accumulated a $2.7 trillion deficit, i.e. appreciable more than 10% of GDP, while U.S. COVID caseloads have reached record new daily highs.

In treating the symptoms without containing the underlying disease, America has chosen a costly and Sisyphean road. To get safely and more quickly to the other side of this health crisis, we believe that the following steps need to be made: 1) prioritize stabilizing public health over re-opening the economy too quickly; 2) extend unemployment benefits and structure these payments so as to encourage workers to return to their jobs more quickly; 3) spend the necessary funds to safely and securely open schools; and 4) keep businesses, especially small businesses, alive during this unprecedented economic turmoil.

In the meantime, we will continue to adhere to our practice of being regimented investors who adhere to clients’ pre-determined strategies aimed at allowing them to achieve their long-term financial goals while taking appropriate levels of risk. This year has been an incredibly challenging and difficult period for the financial markets. However, it is these difficult times that we must suffer through to achieve the long-term benefits associated with growing markets and increasing global wealth. Notwithstanding the horrific consequences already endured as a result of this pandemic, we remain confident that both the U.S. and the rest of the world’s countries will make it through to the other side and return to more normal levels of economic activity in the foreseeable future.

During these difficult times, please do not hesitate to reach out to us at Dumaine. If you have concerns that you want to share or issues you would like us to help you assess, we are always available. We sincerely hope that this letter finds you and your families to be both safe and well during this remarkably trying period.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |