Third Quarter Wrap Up

With the stock market having rebounded sharply from its March meltdown, the S&P is now up a staggering 55% from its Spring lows. While the world continues to battle the COVID pandemic with the hopes of a vaccine or herd immunity continuing to be pushed back, the Federal Reserve has delivered massive monetary accommodation in support of the struggling U.S. economy. In the process, our central bank increased its balance sheet above $7 trillion at the end of Q3. After an initial jumpstart to the economy following the end of most lockdowns this Summer, and combined with the multi-trillion dollar Spring stimulus package from Congress, the economy’s initial rebound has petered out in the face of renewed COVID infections and the expiration of most payroll support initiatives. New unemployment claims rose at the start of October to almost 900,000, the highest level since August. As of yet, the economy has still not replaced almost 11 million of the 22 million jobs lost during the pandemic. September closed with a reported national unemployment rate of 7.9%, 125% greater than February’s near record low unemployment rate of 3.5%. Economists generally expect a 5%+ economic contraction in 2020 – far sharper than that seen from the Financial Crisis of 2008-2009.

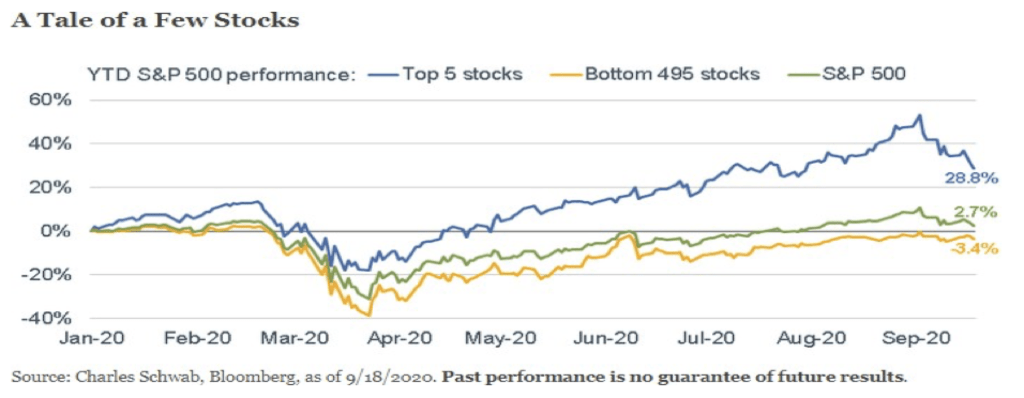

During the third quarter, US stocks bounced back appreciably and showed continued strength even as the global economy shows only modest signs of improvement. The surprising rebound by Wall Street, even as COVID continues to batter the U.S. economy, has baffled many investors. There remains a large disconnect between the market and the economy, mainly driven by a small handful of companies: Microsoft, Apple, Google, Amazon, and Facebook. While the S&P is up +5% YTD, without these high-flying tech companies, the market would be down by more than 6%.

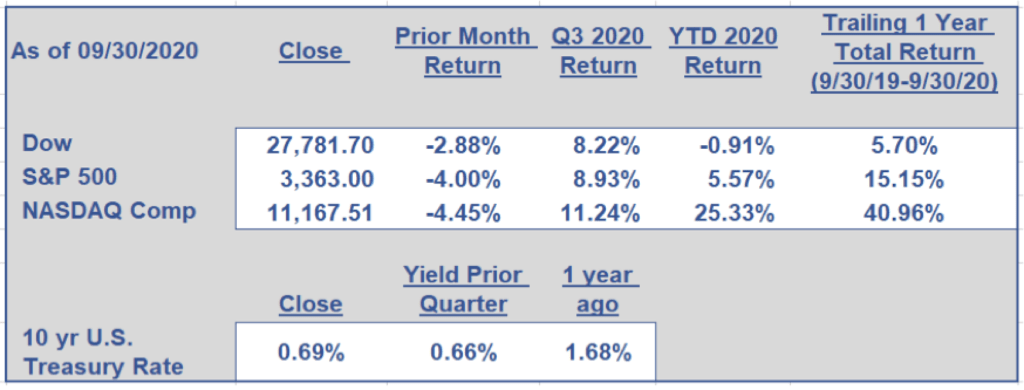

The tech-driven Nasdaq again proved the market leader for the 3rd quarter as the index climbed by more than 11% followed by the S&P 500’s advance of almost 9%. While the Information Technology sector has remained particularly strong with a year-to-date advance of more than 32%, there has been widespread carnage in many other sectors with reduced demand and oversupply yielding a 46% YTD decline in the Energy sector. In the face of the economy’s continued weakness, and a flight to safety by global investors, Treasury bond prices have continued to climb as yields have plummeted. In fact, one of the arguments in support of Wall Street’s continued advance is that equities are not very expensive when compared to the 10-year US Treasury bond’s yield of 0.6%.

Looking forward, stocks could be poised for more advances as investors bet the pandemic will end sooner than anticipated due to the widespread implementation of an effective and widely available vaccine. For the 3rd quarter’s earnings season, investors are wagering that there will be signs that corporate performance has started to turn the corner. Broadly based, analysts anticipate that the S&P 500 profits will record a year-over-year drop of ~20% – an appreciable improvement from the 25%+ decline anticipated only weeks ago.

As November quickly approaches, Wall Street is keenly focused on the upcoming presidential election along with any signs of additional fiscal stimulus being approved by Congress. The ongoing game of chicken between the two parties on this vitally needed relief is sharply increasing the risks in the short to intermediate-term to the economy. The typically fiscally conservative Federal Reserve Chair has gone so far as to strongly state that the risks of providing too little additional stimulus are far greater than the risks of providing too much stimulus. His concerns so far have been unheeded by Congressional lawmakers.

At this stage, we anticipate a grinding and slow economic recovery in the coming quarters barring unexpected action on a new fiscal stimulus or a viable COVID vaccine. In coming weeks, the presidential election will be the key force driving the news cycle as well as the markets. Notwithstanding the staggering shock of the pandemic to our nation as well as the entire globe, we do not believe that COVID has structurally altered the U.S. economy’s long-term energy nor vibrance. While many are concerned about the market’s rapid recovery, they are neglecting to factor in the key consideration that Wall Street is only forward-looking. With security valuations in some areas being quite stretched, our emphasis on appropriate asset allocation based on an individual’s unique financial needs and risk tolerance remains more relevant than ever.

As always, please do not hesitate to reach out to us at Dumaine if you have any concerns or issues you would like to share with us. We continue to hope that this letter finds you and your families both safe and well during these difficult times.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |