2020 Wrap Up

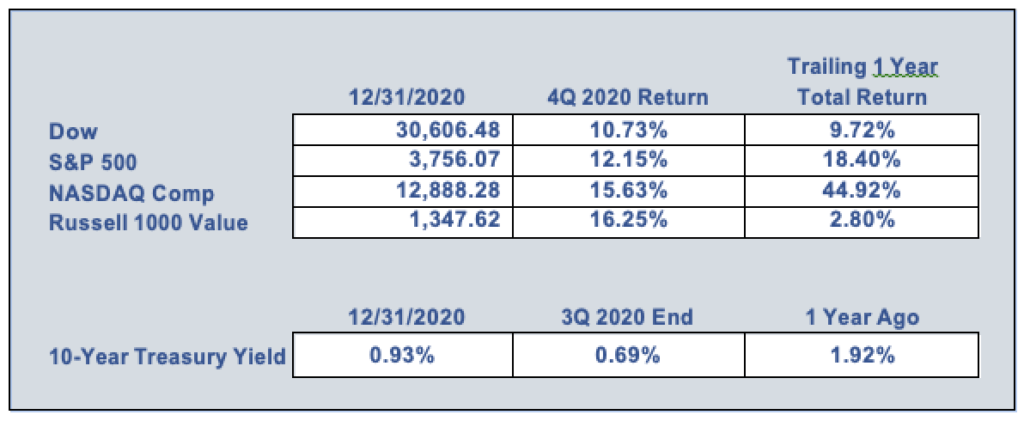

2020 is a year almost all were glad to say goodbye to. However, most investors felt quite the opposite as the U.S. financial markets hit all-time highs: the S&P 500 advanced almost 17% and the NASDAQ, led by the FANGM stocks, returned an astonishing 44%. In addition, even value stocks rallied sharply in the 4th quarter with the Russell 1000 Value Index ending the year up a modest 3%. Making these returns all the more impressive was the markets’ rise amidst a devastating global pandemic. U.S. stocks climbed a staggering 68% from their March lows even in the face of a stunning 31.4% drop in 2nd quarter GDP as the U.S. economy plunged into the deepest recession in modern history. While market strategists’ prognostications for 2020 missed the mark by a country mile with a dramatically weaker economy and sharply lower corporate earnings, the year still yielded significantly higher stock prices.

After the initial COVID lockdowns and the most rapid plunge into a bear market ever seen, the markets spent the remainder of the year rallying almost uninterruptedly. Although vast sums of money poured into consumers’ pockets from Washington’s initial COVID stimulus package, financial relief to the nation’s consumers did not resolve the problem alone. As the initial shock wore off, investors initially focused on those market sectors most likely to benefit from 2020’s new normal, information technology and consumer discretionary, i.e. Amazon and Tesla.

With business and day-to-day life largely moving online in the face of COVID lockdowns, many technology companies’ sales grew sharply as other more traditional businesses suffered severely from the very same lockdowns. Sectors vulnerable to the pandemic such as travel, leisure, energy, and retail were crushed despite the government’s enormous fiscal and monetary support. A resurgent stock market and an enormous fiscal stimulus package propelled the net worth of U.S. households to a record high in the 4th quarter as the values of stock portfolios and real estate surged; this increase underscored the skewed nature of the year’s second-half economic recovery that disproportionately benefited wealthier Americans.

In general, more affluent Americans were relatively insulated from the year’s travails while millions of lesser-skilled workers in more vulnerable sectors such as retail, tourism, and travel saw their incomes sharply decline as firms furloughed or laid off more than 20 million people in a matter of mere weeks. Notwithstanding the sharp recovery from the 2nd quarter’s dramatic

plunge, the U.S. labor market has only regained 12 million of the 22 million jobs lost at the onset of the pandemic. From near record lows of 3.5% in early 2020, unemployment spiked to a staggering 14.7% in April amidst the worst of the nation’s lockdowns before gradually declining to 6.7% at year-end.

LOOKING AHEAD

The introduction of COVID vaccines in recent weeks and experts’ predictions that much of the globe will be vaccinated by late 2021 or early 2022 has caused much relief throughout the world. On the back of these expectations, the International Monetary Fund currently projects global growth of 5.4% in 2021 – the highest growth rate in many years. Unfortunately, this forecast for 2021 comes on the back of the most severe global recession in decades where global economic output is estimated to have shrunk by more than 4.5% in 2020 as a result of the COVID pandemic and its related economic lockdowns.

On balance, we believe a more bullish outcome is likely for 2021 as the markets by definition are forward, rather than backwards, looking. Analysts see substantial upside to services spending over coming quarters for the areas that were most severely impacted by COVID such as dining, recreation, transportation, and tourism. Thus, higher growth should see these areas return to more normalized levels by year-end. The rotation back into these market sectors and away from 2020’s winners in the information technology and consumer discretionary sectors is a likely investment theme for the year. Amongst the most bullish analysts, another double-digit market advance is projected as the successful distribution of vaccines underpins a lasting economic recovery. Critical to this storyline playing out are the following events occurring:

- the public expediently accepts and receives COVID-19 vaccines;

- equity investors appropriately project the success of the vaccines in reversing the economic disruptions brought on by the pandemic;

- the U.S. Federal Reserve and other central banks continue their low-interest rate regimes in tandem with accommodative monetary policy; and finally,

- Congress approves another round of fiscal stimulus in the year’s first quarter.

Clearly, the most critical factor in the coming year is the successful rollout of the COVID vaccination. Without substantial success in this vital initiative, the rest of the year’s promise will quickly fade. A large unknown is how the White House and Congress will shift or change tax policy. As this letter goes to press, for at least the next two years the Democratic Party will control both houses of Congress along with 1600 Pennsylvania. Historically, the most productive

Congresses have been those where power was shared due to the need for bipartisan compromise. Conversely, when one political party controls both the legislative and executive branches, more extreme outcomes have resulted that have often had less beneficial effects on the economy and the financial markets. In the near term, it appears as though Wall Street is being buoyed by the belief that the new Democratic presidency will take a more coordinated and proactive stance in addressing the nation’s worsening COVID pandemic. Initially, we believe COVID will be the new Administration’s primary focus and the White House will not focus on larger policy changes until the near-term health crisis is more under control.

Ultimately, the stock market is dependent on economic growth to drive corporate revenues and earnings. Without substantial success on the COVID front, economic growth will falter if not slide. While the way forward remains murky, we believe the appropriate tools are at hand for government and policymakers to resolve the ongoing health and economic crises. We now need to wait and see if these instruments are both used timely and correctly.

It is in uncertain times such as these where it is vitally important to take on only suitable levels of risk relative to your unique situation. If you care to reach out to us regarding your own personal situation, please do not hesitate to do so as we are always available and happy to be of help. Finally, we want to wish you and your loved ones the very best for 2021 and hope this letter finds you safe and well during these trying times.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |