First Quarter Wrap Up

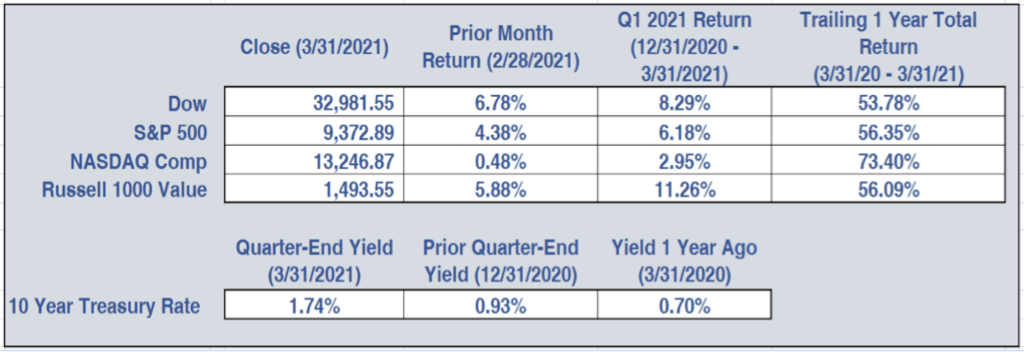

The first quarter’s end marked the best 12 months in the history of the S&P 500. After hitting bottom at the onset of the COVID pandemic, the broader market rallied more than 70% with the average stock almost doubling during this time period. Even the Russell 1000 Value, which does not typically include growth stocks, showed remarkable strength in the last year as it advanced more than 54% since last March. Through the first quarter of 2021, Wall Street has continued its year-long surge with the Russell 1000 Value dominating as it increased by more than 11% since January 1st while the S&P 500 only gained 6.2%. The Nasdaq, which was 2020’s strongest performer with a 45% return, is up only a meager 2% year-to-date.

The two main factors driving the market’s renewed surge have been the Biden Administration’s $1.9 trillion fiscal stimulus package and the increasing belief the COVID vaccine rollout in the U.S. has been going well. However, potential inflation risks from the Biden stimulus package have investors nervous as March’s inflation reading surged to 2.6%, the largest monthly increase in several years. As a result, attention has shifted to the 10-year U.S. Treasury, which has climbed an astounding 90% in the first quarter to a yield of 1.74%. The size of the interest rate shift, however, was momentous and has experts questioning the Federal Reserve’s current strategy of holding short-term rates unchanged in the face of an extremely rapid improvement in the country’s economic outlook. The market has now pulled forward its expectations of when interest rate increases will be implemented which has contributed to the recent Treasury sell-off.

Additionally, the new Administration has recommended funding its proposed infrastructure package by sharply increasing taxes on corporate profits over the next 15 years. If this change in tax policy were to occur, it would act as a substantial headwind to the market’s continued advance. Meanwhile, investors are still dissecting the potential impact of President Biden’s proposed infrastructure plan on both the market and the economy. Although received favorably in a number of quarters, the Biden infrastructure plan is going to have a difficult path through Congress as Republicans want no part of the corporate tax hikes needed to pay for the plan while progressive Democrats are upset the plan does not go far enough.

Another interesting occurrence has been the sector rotation out of COVID-related stocks and into market sectors that were neglected last year. Shockingly, the energy sector, which was far and away 2020’s worst-performing sector with an almost 34% decline, staged a recovery of more than 30% in the first quarter. Meanwhile, the Information Technology sector which dominated the market last year with a 44%+ return was the quarter’s laggard as it only advanced 2%. Interestingly, the Russell Value index beat the Russell Growth index by more than ten percentage points in the first quarter, the largest out-performance in 20 years. As growth stocks are far more sensitive to rising interest rates than value stocks, this outcome was largely anticipated.

Thankfully, the biggest news in the last 3 months has been the rapidly improved COVID outlook. The quarter started with the pandemic continuing to sharply worsen nationwide. In a matter of months, the U.S. vaccine rollout has been one of the fastest globally with U.S. daily cases concurrently declining by more than 75% to ~70K new cases/day. In addition, this sharp caseload reduction has allowed the government to start more aggressively re-opening the economy. With the narrow passage of the massive second COVID stimulus package of $1.9 trillion, the economic outlook has been turbocharged with an initial 2021 GDP forecast for a gain of 4.0%, a staggering jump from the previous year’s decline of 2.5%. Even so, this upbeat forecast may still be too timid if a 4th COVID wave is averted and U.S. consumers quickly open up their relatively full wallets.

In any case, the situation remains incredibly fluid. A $1.9 trillion COVID stimulus package and 100 million COVID vaccinations later, the 2021 growth forecast has been further raised by more than 65% to 6.3% for the year. If these economic forecasts are achieved, the nation’s economy will experience its most rapid growth in almost 40 years. The recently passed $1.9 trillion relief package equals 8% of U.S. GDP while American households also have $2.8 trillion more in savings than pre-pandemic. If these funds are spent with the re-opening of the nation’s economy, they will provide an enormous surge in demand which the Federal Reserve anticipates producing an inflationary surge. The unknown answer is how quickly households will return to more normal spending levels in the severely depressed services sectors of tourism, dining, and live entertainment. A rapid rebound in these industries could be limited solely by the sector’s ability to quickly respond to a rapid surge in long-suppressed demand.

Similarly, the International Monetary Fund now anticipates the global economy to grow by at least 6% this year – the fastest pace in four decades spurred on by vaccine rollouts accelerating and advanced economies spending aggressively. While this level of growth would be the most robust in decades, it would come on the shoulders of a historic 3.3% decline in 2020’s global production; 2020 produced the worst peacetime economic performance since the Great Depression. Key drivers of this robust recovery will be the world’s two economic superpowers, the United States (with projected growth of 6.4%) and China (with projected growth of 8.4%). The challenge, however, is that the global rebound will largely be centered on the developed world with the economic recovery being far less robust in the poorer emerging and developing economies. The world’s poorer countries have an appreciably more difficult couple of years ahead of them given their lack of financial resources to readily buy vaccines or provide fiscal stimulus to their economies.

In totality, Wall Street has incorporated much optimism into projected economic growth over the next 18-24 months. If these high spirits prove unwarranted, the markets could respond sharply to the downside. As things stand now, the market’s volatility, typically tracked by the VIX index and known as the “fear gauge”, currently stands appreciably below normal levels. This type of reading typically indicates complacency by investors regarding the current and near-term market environment. The apparent lack of concern by investors makes appropriate portfolio positioning and risk assumption more vital than ever.

If you have issues or concerns that you would like us to help you address, please do not hesitate to reach out to us – we are always happy and available to be of help. Wishing you and your loved ones the best for 2021 and hope this letter finds you all safe and well.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |