Second Quarter Wrap Up

The June-ended quarter was remarkably different than this year’s first quarter in that a combination of vaccine rollouts and stimulus payments had America ready to start embracing a post-pandemic life. As the economy continued its recovery from COVID, the second quarter marked one of the best first half years in the market since 1998. The market and the economy continue to reap the benefits of the pandemic recovery from the COVID recession as new cases of coronavirus keep falling, people continue receiving vaccinations, and economic growth keeps rising. April began with heightened fears of inflation driven by $386 billion in new stimulus payments along with $2 trillion in extra savings that were socked away during the pandemic. Investors hoped that these funds would be spent gradually so that American businesses would be able to readily meet growing demand. Instead, supply bottlenecks and unexpectedly robust inflation have occurred as Americans embrace moving beyond the nation’s lockdown, reuniting with family and friends, and starting to go out and travel.

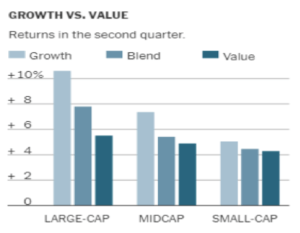

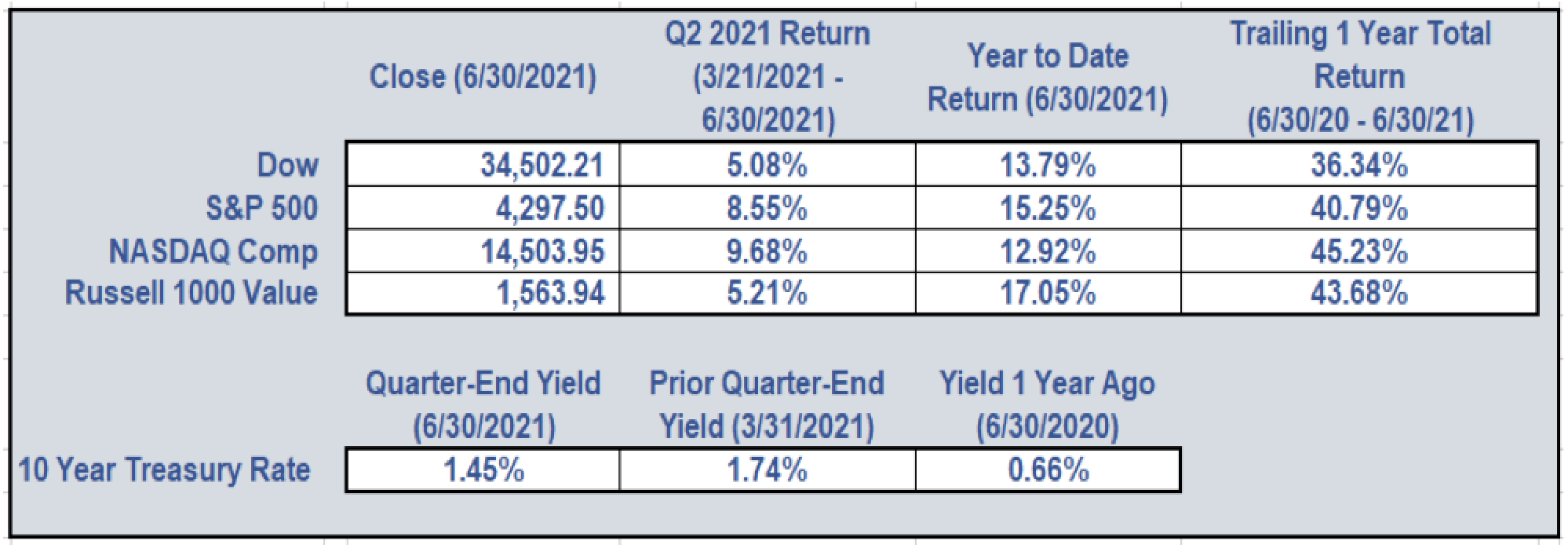

Second-quarter market trends support our thesis that the current inflation spike is transitory in nature. Inflation fears initially declined and we saw growth stocks re-gain their prior year’s momentum with advances of 9.7% and 8.6% by the Nasdaq and the S&P500, respectively. In comparison, the Russell 1000 Value advanced a relatively modest 5.2% in the 2nd quarter.

During June, the Federal Reserve focused on the possibility that inflation could accelerate and persist more than expected. Key to this concern was the sharp increase in the bank’s preferred measure of inflation, the personal consumption expenditures (“PCE”) index which rose by 3.6%, 3.9%, and 5.4% in April, May, and June. The recent increases have been the largest in almost 30 years, but we believe it is primarily, if not almost exclusively, the result of the economy’s quick re-opening combined with the extreme level of Federal fiscal stimulus since the start of the COVID pandemic. In response to this data, the Fed released minutes discussing the possibility of raising interest rates sooner than expected as well as tapering its current $120 billion in monthly bond purchases. These moves illustrate how officials have been caught off guard by the stronger-than-expected surge in price pressures as inflation has persistently stayed beneath 2% for the past decade. While some investors believe inflation may stay above 3% as the economy normalizes after reopening, the Fed’s latest forecast implies that inflation will fall to 2.1% in 2022.

So far, the bond market is not buying into the argument for higher structural inflation as bond yields have appreciably declined in recent weeks. Furthermore, the decline in interest rates suggests expectations of slower growth and more subdued inflation lie ahead. The yield on the 10-year Treasury fell to 1.29% at the end of June from its recent high of 1.75% in March. Current Treasury yields imply annual inflation expectations of 2.25% over the next decade, appreciably lower than expectations of more than 2.5% in early May. The Fed continues to stand behind its longer-term aim of 2 percent inflation; however, the central bankers have indicated that they could act sooner if inflationary pressures continue to rise.

In the end, markets are not all-knowing, and the signals being sent by bond prices could turn out to be wrong. But investors with trillions of dollars collectively on the line are betting that the vigorous economy of the summer of 2021 is going to give way to something a good bit less exciting but more stable as we enter into 2022. While the U.S. is fully recovered from the pandemic on a GDP basis, recovery in the unemployment rate is clearly going to take more time as it still stands sharply higher than just prior to the pandemic’s start.

MOVING FORWARD

The number of U.S. job openings has held at record levels headed into the summer as employers seek to fill positions from the limited pool of workers willing to return to work at prevailing wages. Since early 2020, there has been a sharp drop in labor-force participants. In just 16 months, 2.7 million potential workers have removed themselves from the workforce; this decline appears to have stemmed from fears of contracting COVID, difficulty in getting childcare, and generous unemployment benefits. In the coming quarters, we anticipate these factors to slowly dissipate and allow those seeking work to appreciably grow. In the face of surging economic activity, most pandemic relief spending will also be ending soon. Despite the Biden Administration’s discussion of its large, proposed infrastructure bill, which is in fact largely pork barrel populist spending, many do not believe that Congress will approve appreciably more unfunded spending this year. The big question remaining is how the outlay of pent-up consumer demand will play out.

Where are we headed next? Many analysts believe the markets may continue to ultimately thrive in the reflationary environment of strong, above-trend economic growth and ample liquidity conditions; however, most analysts do not expect there to be smooth sailing. Unanticipated bouts of volatility are likely, especially as the market’s fear gauge has once again declined towards historic lows. For those worried about inflation, it is important to remember that a diversified portfolio over time has historically performed well. Investors are keeping a close watch on inflation, interest rates, and any reduction in central bank bond purchases to get a feel for coming market movements. As Wall Street regularly continues to hit new highs, the Dumaine team believes that staying the course with a prudent and diversified approach appropriate to your unique risk tolerance and cash needs will yield the best results for your financial future.

We are always available to answer any questions you may have, please do not hesitate to reach out. We hope that this letter finds you and your loved ones safe this summer.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |