Third Quarter Wrap Up

The third quarter of 2021 was a roller coaster with elevated inflation fears, talks of reduced monetary easing, supply chain bottlenecks, higher energy prices, and rising interest rates. As a result, the market’s fear gauge climbed by almost 50% during the quarter. When coupled with a fourth wave of COVID, which is only now abating, slightly slower U.S. economic growth is now projected. To make matters more unpredictable, concerns have risen regarding systemic risk to the global economy from China’s quickly unfolding real estate crisis. The Chinese leaders have further piled on to current concerns by undertaking increasingly aggressive military maneuvers in an attempt to further intimidate Taiwan as well as illegally laying claim to the natural resources of the South China Sea. These ongoing Chinese actions have sharply increased political tensions both regionally and globally.

On the jobs front, the imbalance between jobs available and people looking for work remains stark with nearly 10.8 million jobs available and almost 8.7 million unemployed people actively looking for work. That being said, one of the quarter’s few bright spots was employment; unemployment dropped from 5.4% in July to 4.8% for September although unemployment filings have been trending upwards in recent weeks. Notwithstanding the issues raised above, the biggest topic worrying the financial markets at the moment is inflation. To be more precise, investors are debating whether the last several months’ sharply higher price readings are temporary or structural in nature. The three latest core PCE readings (the Fed’s preferred measure of inflation) have increased a startling 3.6%, or almost double the Fed’s target of 2.0%. If the PCE readings continue at their current rate, they would produce the highest rate of inflation seen in almost 30 years. To put this PCE figure more in perspective, the most recent month’s reading was more than twice the rate incurred a year ago. Meanwhile, the more commonly followed CPI (consumer price inflation) index increased by an astonishing 5.3% in August and 5.4% in September, albeit sharply skewed by more volatile food and energy prices. The concern from both of these readings is that if inflation becomes embedded in day-to-day economic activity, a sharper fiscal and/or monetary response will be needed to rein in price increases to more acceptable levels. In short, a little bit of inflation, i.e., the Fed’s target of 2.0%, is a desirable outcome, while a lot more or a lot less can be quite bad for the overall economy.

Driving this unexpected surge in prices are supply chain disruptions, unexpectedly robust consumer demand, and rising energy prices. However, the U.S. central bank expressed its continued belief that the recent increase in prices is transitory rather than structural. The latest Fed projections have inflation ending the year at a 3.7% annual rate before falling to 2.3% in 2022. These projections are consistent with our belief that many of the current inflationary drivers will start to abate before price increases become endemic to our economy. We, like the central bank, believe the recent inflationary surge to be more the result of “cost-push” of prices driven by pandemic re-opening effects and shortages rather than typical “demand pull” version of inflation where too many dollars are pursuing too few goods. Exacerbating the recent price escalation has been the enormous fiscal stimulus provided by the several COVID relief packages which flooded the U.S. economy with additional dollars. Now that these programs have expired, there will be less fuel to feed inflationary fires, and we should shift more towards transient cost push-driven inflation.

Along with inflation though, another key economic concern has been the recent surge in supply chain bottlenecks. Recently, Federal Reserve Chair Powell admitted that it is “frustrating to see bottlenecks and supply chain problems not getting better and holding longer than we thought.” Although, the banker continued to express his belief that this was a temporary happening rather than a permanent change. As reported by the Wall Street Journal, our ports are brimming with excess containers that cannot be moved due to trucker labor shortages while wait times for unloading ships’ cargo have roughly doubled. Because the exports of U.S. goods have not kept up with imports, container ships are reluctant to wait to take back empty containers to Asia where many vital imported goods are being produced.

Market sentiment has been further degraded by the ongoing Congressional gridlock. As we go to press, the debt ceiling issue was kicked down the road two months, but action is still being sought on the $1 trillion infrastructure and new entitlements package along with the proposed $3.5 trillion budget. In short, this is nothing new for a closely divided Congress where it often waits until the 13th hour to come up with a contentious compromise.

WALL STREET AND THE MARKETS

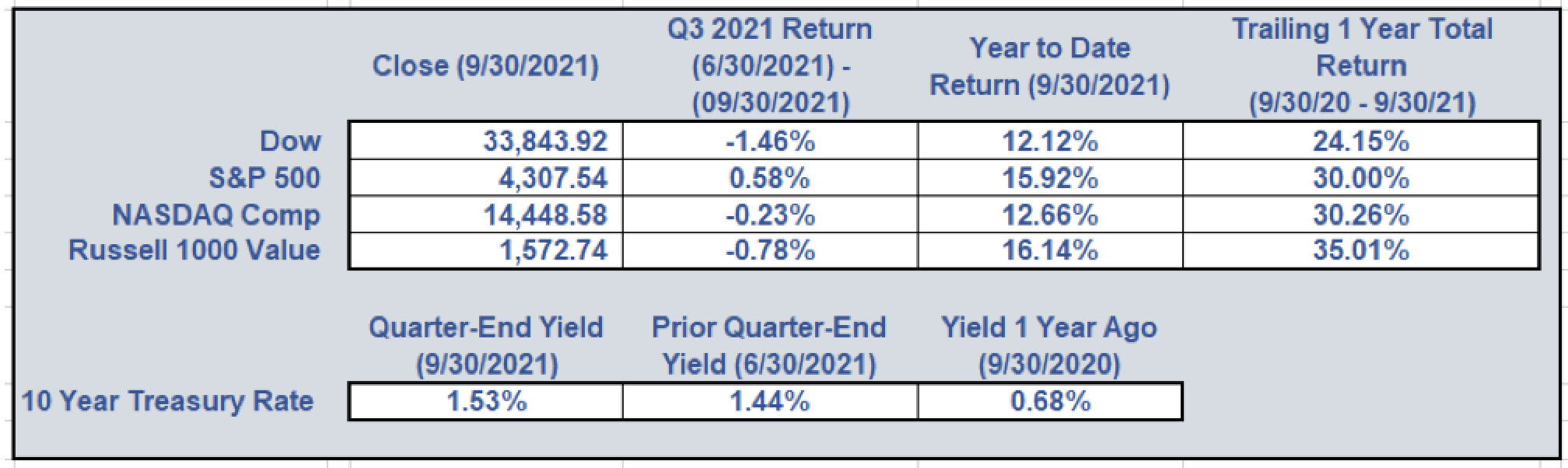

The Dow Industrials, the Nasdaq, and the Russell 1000 Value all declined slightly during the quarter as September’s losses ate up the summer’s earlier gains. Only the S&P 500 ended up for the period with a modest gain of 0.5% although the S&P ended a streak of gains for seven consecutive months in the face of September’s declines. Even the bond markets have started showing some concerns as the 10-year Treasury’s yield rose by more than 40% from its July lows to a 1.52% yield at September-end. Key drivers of the bond market’s decline were a 2nd consecutive rise in weekly jobless claims along with the Fed’s indication that it was likely to reduce its easy money policy in the near future. The prospects of potentially higher interest rates caused investors to favor large-cap stocks at quarter’s end, allowing the S&P to eke out a modest quarterly gain. Meanwhile, OPEC+ stood firm at its most recent meeting thereby driving oil above $75/barrel. Consistent with energy prices, the entire commodity sector has been on a tear in recent months as demand for raw goods has sharply increased in the face of the ongoing global economic recovery, thus causing the Bloomberg Commodity Index to rise by more than 29% – its largest gain in more than 40 years.

If it continues, inflation, combined with continued supply chain disruptions, could start to impact corporate profit margins significantly. If an increasing number of companies warn about future profitability due to these factors during the upcoming third-quarter earnings season, negative sentiment will likely markedly increase. On the back of a 90%+ rise in oil prices in 2021, it should come as no surprise that the energy sector has led the market upwards year-to-date with a gain of more than 43%. Conversely, as the COVID pandemic is appearing to start to come under control, the staples and utilities sectors have appreciably lagged the market with each returning ~4.5% year-to-date as investors have leaned away from more stable enterprises in search of higher growth opportunities.

MOVING FORWARD

Recent earnings warnings have caused upward momentum in analyst estimates to slow down, which has in turn reduced the market’s recent upward momentum. Many believe the market is stretched from a valuation perspective and have expressed surprise that new record highs have been achieved despite increasing volatility. However, we see the current situation to be an expected outcome of the massive Federal fiscal stimulus combined with the Fed’s extraordinarily easy monetary policy – all done to smooth the economic bedlam caused by the COVID pandemic. The concern moving forward is how will the market respond when the Fed ceases it bond-buying program later this year or starts raising rates – an action anticipated as soon as late 2022.

At this stage, it appears as though the U.S. central bank is more focused on inflation than about providing further help to the economy as current projections have U.S. production growing by a robust 5.9% for the year. Notwithstanding the potentially stretched equity valuations, earnings forecasts are for the S&P 500 to increase profits by more than 27% for the 3rd quarter – the 3rd highest growth in 20 years. We still believe the most likely scenario is interest rates will gradually move higher as the Fed carefully winds down its easy money policy. Because of the likelihood of increased interest rates, we have been avoiding longer-maturity bonds and are positioned at a meaningfully shorter maturity than most bond averages.

In the meantime, we are continuing to maintain our focus on only taking the appropriate level of risk for each client to help them achieve their specific long-term financial goals. In turn, we continue our efforts to find risk-appropriate securities we feel have an attractive upside while managing risk through our bottom-up and top-down, value-oriented investing style. As always, if there is ever anything we can do to help, please do not hesitate to reach out to us. We are always available to answer any questions you may have. Everyone at Dumaine hopes that this letter finds you and your family safe and well this fall.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |