Can We Please Just Put COVID Behind Us?

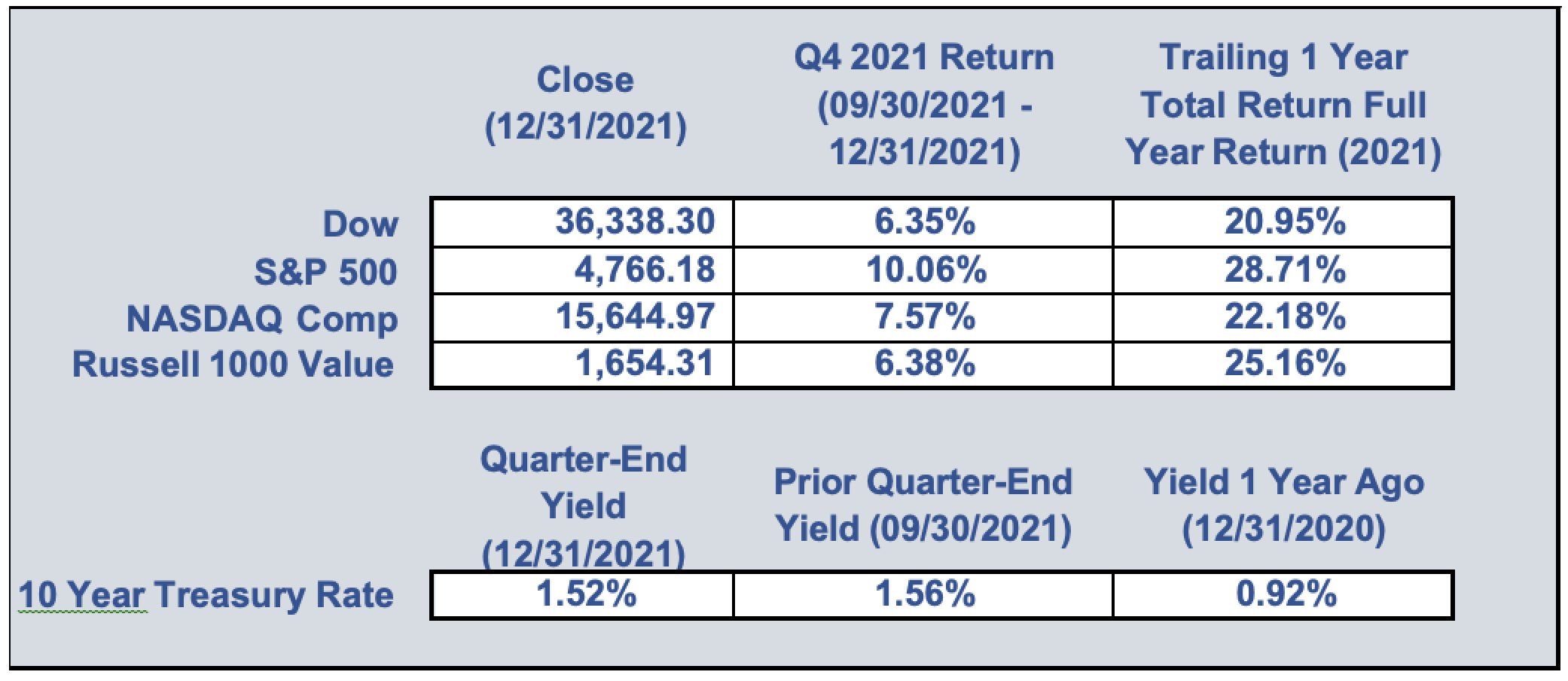

When looking back on 2021, the financial markets seem like a blur. Despite the year’s turmoil, the U.S. markets still posted strong double-digit returns. The S&P Index returned 28.7% for the year, while Dumaine’s stock benchmark, the Russell 1000 Value, advanced almost as much with a 25.2% gain. The year started with the market-leading technology stocks, known as the FAANGM, trading at record highs with world hopes that several new vaccines would quickly reduce or even eliminate COVID. A sector rotation out of 2020’s high-performing consumer discretionary sector caused the energy sector to swing from a stunning 35% loss in 2020 to a phenomenal 53% gain in 2021. Some bullish analysts had predicted that we would see a rotation out of COVID stocks and back into COVID-impacted sectors such as dining, recreation, transportation, and tourism; this rotation ended up playing out in the year’s first quarter. However, the year’s start also saw an initial spike in inflation, primarily driven by $386 billion in new Federal stimulus payments along with $2 trillion in extra consumer savings. As a result, the March price consumer expenditures index rose by a sharp 6.4%. On the back of predictions for a quick recovery from COVID due to the new vaccines, 2021’s 2nd quarter closed out the best 12-month’s stock performance in modern history. Wall Street’s surge was largely driven by 2020’s $1.9 trillion Federal fiscal stimulus package and the initial belief that the COVID vaccine rollout in the U.S. was going well.

MARKETS TRANSITIONED AS 2021 PROGRESSED

Entering the year’s third quarter, Wall Street began to hit some bumps largely due to investors’ heightened fears of inflation which was in part caused by worsening supply bottlenecks. Adding to investor concerns were central bankers’ initial discussions of monetary tightening, higher energy prices, and rising interest rates. In the face of this changing landscape, the market’s fear gauge climbed by more than 65% from its early July lows. In the fourth quarter, the Federal Reserve concretely shifted its monetary position and started to express increasing concerns about inflation. To start taking its foot off the monetary gas pedal, the U.S. central bank announced the tapering of its bond-buying program. Historically, falling nominal bond yields, accelerating inflation and a petering out of positive economic surprises have been consistent with fading economic growth. Also, this situation usually creates a more volatile situation for riskier assets. With the dollar remaining the global reserve currency and the Fed announcing imminent monetary tightening, the real (after inflation) yield curve steepened further as global investors poured funds into the U.S. fixed-income markets. Meanwhile, the Fed’s revised announcement predicting up to 3 or 4 rate increases in 2022, up sharply from earlier projections of potentially 2 rate changes towards year-end, has put investors on edge. Obstinately low real yields help to explain why there has only been minimal effect on the stock market as of yet. Higher real yields, when they eventually arrive, are sure to increase market turbulence.

LOOKING AHEAD

For now, even in the face of planned rate increases, low real interest rates continue to provide support to current stock valuations. However, COVID, and its various ramifications to supply chains, available healthy workers, governmental shutdowns, etc., are going to remain the year’s key market driver as worldwide infections hit more than 3.5mm/day in recent days. With this staggering surge, COVID’s new daily caseload has increased more than 3-fold the prior daily record. Given the many twists and turns of the ongoing pandemic, analysts have consistently struggled with their economic projections. While still currently upbeat, the World Bank’s projections of global growth have been reduced modestly for the year from 4.4% to 4.1%. Notwithstanding the ongoing pandemic, expectations could easily be blindsided again. In the face of the above-referenced uncertainties, the U.S. unemployment rate has surprisingly continued to improve with January’s reading of 3.9%. The base economic case appears to be a continued recovery with gradually cooling prices and a shift away from emergency monetary-policy actions by both governments and central banks. The risks to this scenario remain substantial. Even beyond COVID’s direct impact, the risks to global growth are abundant and they include: stickier than anticipated U.S. inflation, tightening Fed monetary policy, China’s zero-COVID policy, and an added strain on an already over-burdened supply chain along with sharply rising food prices.

While these concerns exist, some matters may yet prove better than expected – only time will tell. For the moment, Wall Street’s attention is turned towards the recently commenced fourth-quarter earnings season. Earnings started out rocky with a mixed bag from the nation’s largest banks. The current consensus is that earnings from last year’s final quarter will advance further- even as worries about surging COVID daily cases gave investors some pause in December. A strong showing on the earnings front may be needed if the U.S. stock market is going to continue its upward push. This task will be made more challenging once the Federal Reserve starts to implement its already foreshadowed rate increases. Although the U.S. central bank has backed off on targeting a precise inflation rate for the time being, it is aiming to rein in price increases before they become structurally embedded in the economy. Investors are hopeful that recent gains in consumer spending and continued expansion in manufacturing activity suggest the economy could be strong enough to overcome the Fed’s upcoming actions. While equity market valuations remain elevated following the strong conclusion to 2021, we continue to maintain appropriate concentrations of stocks in our portfolios. Now, more than ever, it remains vital that clients assume no more risk than is necessary for them to safely achieve their long-term financial goals.

We hope that your 2022 is off to a great start. As always, please do not hesitate to reach out to us if we can be of help in any fashion – we are here to help our clients in any possible way.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |