Why Does 2022 Seem So Awful?

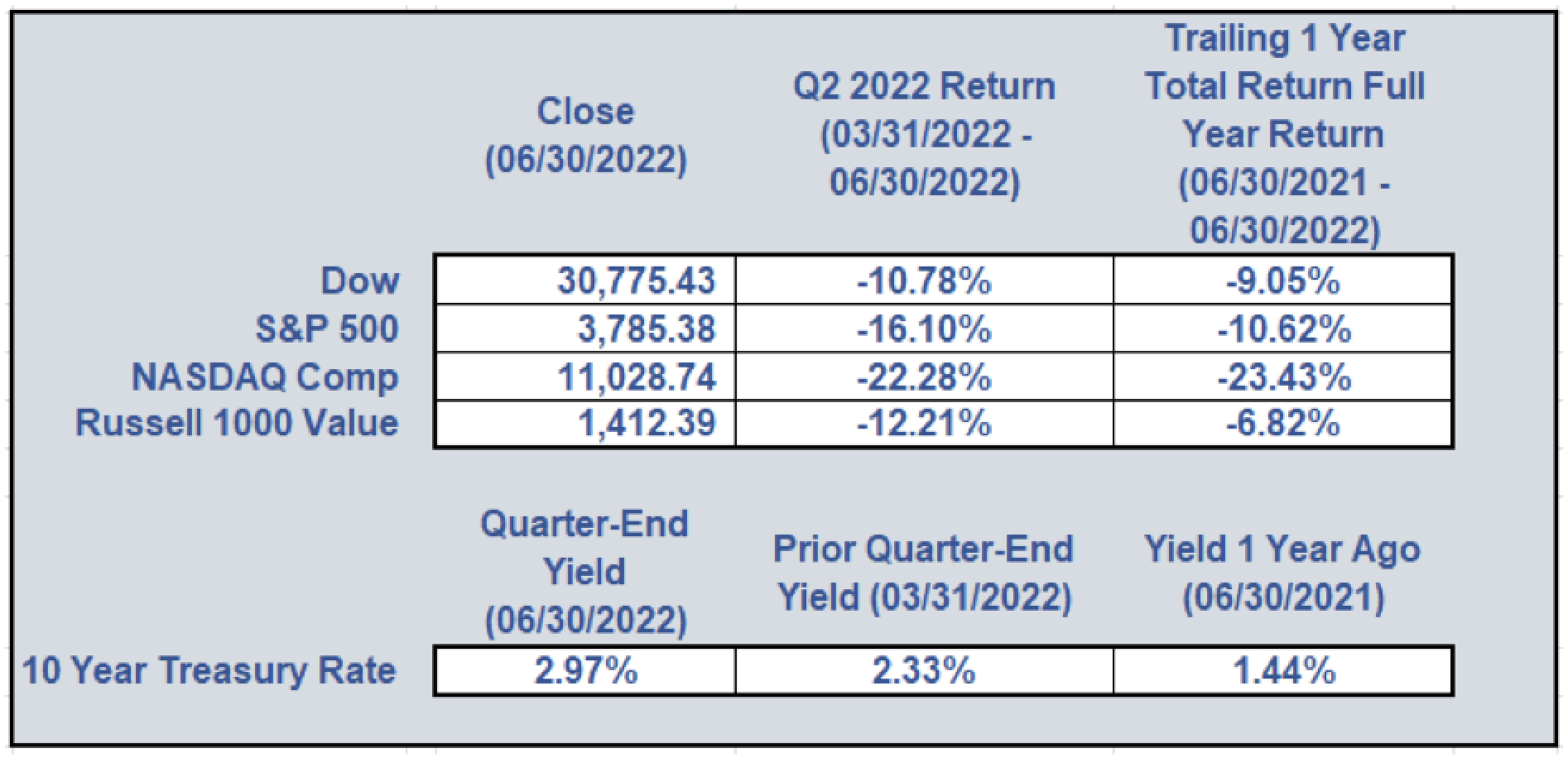

After a mixed but relatively flat first quarter, the market’s wheels fully fell off the bus in the second quarter and the markets have since sharply weakened with a broad selloff in stocks, bonds, and cryptocurrencies. Following three consecutive years of appreciable stock gains, the market closed out the first half of 2022 with the S&P 500 down ~20% and the Russell 1000 Value, Dumaine’s benchmark, down almost 13%. The specter of an economic downturn contributed to the market’s worst first-half of a year in half a century. In fact, investors have seemingly lost their appetite for risk in recent months as value stocks are on pace to outperform growth stocks for the first time in years. Growth stocks, which typically underperform in rising rate environments since their future earnings are more sharply discounted, have sharply led the market lower. Since 1960, the S&P 500 has only had two first-half losses greater than this year’s 20% drop. Surprisingly, sharp losses in the year’s first half have historically led to strong rebounds in the year’s remaining quarters. Whether such a turnaround will be realized in 2022 remains uncertain given the many clouds on the economic horizon.

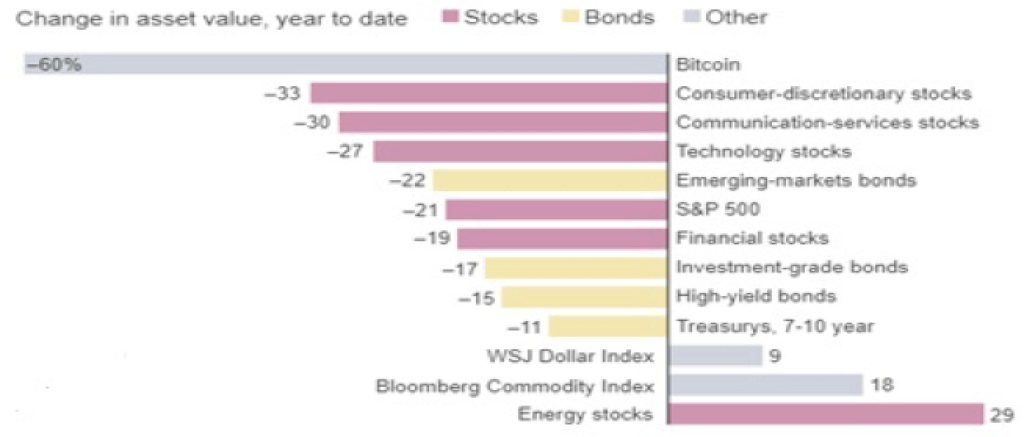

Losses have not been limited to stocks as the 10-year Treasury yield rose to its highest level since 2010, peaking at almost 3.5%, before closing the quarter just below 3%. Meanwhile, U.S. natural gas and petroleum prices reached their highest levels in more than a decade in the face of growing European demand coupled with efforts to reduce Western countries’ reliance on Russian energy. Despite government attempts at market intervention, U.S. oil prices climbed by more than 40% in the first half of the year. Additionally, in the face of Russia’s ongoing invasion of Ukraine, grain prices have surged almost 20% this year as Russia and Ukraine, two of the world’s largest grain exporters, have largely been shut out of international markets. For those seeking shelter in the new fool’s game, i.e., cryptocurrencies, investors have experienced enormous losses with the sector’s leader, Bitcoin, as it has now declined by more than 70% from its peak last year. Year to date, the only market sectors to have gains are limited to energy and commodities with other sectors experiencing losses of as much as 30%+, such as the consumer discretionary sector.

There have been few safe havens world-wide as global growth projections have slumped to less than 2.9% for 2022, down from initial projections of 4.1% and sharply lower than the 5.7% growth experienced last year.

WILL THE FED’S ATTEMPT TO TAME INFLATION LEAD TO RECESSION?

It has been two years since the onset of COVID rocked markets, and the U.S. and global economies are now experiencing rampant and persistent inflation, not the transitory inflation that most had anticipated. In the face of sharply rising prices, U.S. consumer inflation has surged 9.1% over the last 12 months – the highest rate in more than 40 years. In turn, these unexpectedly sharp price increases have forced the Federal Reserve to hike interest rates at its fastest pace in decades. Driving the Fed’s aggressive actions has been its keen desire to prevent an inflationary mindset from becoming embedded into the economy. When consumers start expecting continued high levels of inflation, it has proven historically to be a self-reinforcing and non-virtuous cycle. Through its action, the Fed is hoping to avoid this worst-case scenario.

In the last 3 months, mortgage rates have nearly doubled with inflation driving Americans to increasingly eat into their savings. Central-bank officials worldwide have signaled that they are now more concerned with taming inflation than with an economic slowdown, except for China which continues to follow its draconian Zero-COVID policy – no matter the economic consequences. Following the unexpectedly high June American inflation reading, some U.S. central bankers even came out with support for a possible one percentage point increase at the next interest rate setting meeting at July end. In hindsight, the Fed should have started taking more aggressive moves late last year and the Administration should have been slightly less extravagant in its COVID-related largess. If so, the U.S. economy would be looking better, albeit still struggling from the continuing COVID pandemic and the ramifications of the Russian invasion of Ukraine. The quandary now for the Fed is when is enough enough?

Fortunately, Americans have built a substantial buffer against rising prices as household savings are at their highest levels in decades at more than $2.6 trillion; however, the savings rate has plunged in recent months to only 5.4% in May – appreciably below the last decade’s average. Largely powering the current substantial U.S. savings pool is the enormous pandemic-related government assistance of the last two years. In recent months, the nation has become increasingly concerned about the economy’s state as consumer sentiment, as measured by the University of Michigan’s Consumer Sentiment Survey, has plunged to levels not seen since the Financial Crisis.

Notwithstanding the current consumer pessimism, the job market has remained quite robust with a 3.6% unemployment rate, a near several-decade low with many businesses continuing to desperately seek new workers. In fact, there are approximately two job openings currently available for every one job seeker. With the first quarter’s economy shrinking by 1.6%, the possibility of a recession is real although most experts expect a modest bounce back to growth in the second quarter to ~1.0%.

WHAT COMES AFTER THE MARKET SELLOFF?

After the worst first-half stock market decline in half a century, outlooks for the second half of 2022 are mixed and investors are contending with a fresh set of challenges. Some think there is plenty of opportunity and the prices of good quality assets look attractive. Others believe the foundations are being set for a recession and expect it to start no later than early next year. While investors have not seen such a rapid market downturn in almost 50 years, there are almost always significant bouncebacks in the face of sharp market declines. Defensive sectors have outperformed more economically sensitive sectors which tells us investors are more focused on the growing risk of a recession as compared to the likelihood of a soft economic landing.

Yet, the World Bank recently slashed its growth forecast for the global economy to 2.9%, down from January’s prediction of 4.1% and April’s 3.2% estimate and has warned that several years of above-average inflation and below-average growth may lie ahead. The markets understand the outlook is clouded and most are hopeful that a recession, if it occurs, will be mild, and will not hit until next year. However, the economic data along with investor and consumer sentiment are largely headed in the wrong direction. The dangers are big, and the markets may not be fully prepared; only time will tell.

THE WAY MOVING FORWARD

While we understand concerns may be high in the current market, we are not market timers, and we are seeing increasing buying opportunities. In recent weeks, we have started to avail ourselves of these new opportunities; however, it remains a strong possibility that these new investments could see additional downside in the near term even though our longer-term share price expectations remain quite robust. In the end, we stand by our long-held belief that investors should follow their thoughtfully designed investment policies through good times and bad times. In our opinion, the sole reason to make a change to an investor’s strategy during market turmoil is because of a change in an individual’s personal situation, not simply in reaction to the ever-changing markets. Over time, the benefits of such consistency have historically been well rewarded.

As always, we at Dumaine hope this newsletter finds you and your loved ones safe and healthy. We are always available to discuss any of your personal concerns or issues – please do not hesitate to reach out to us at (504) 521-7350.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |