2022: A Series of Unfortunate Events…

The year was one of tumult for most economies as growth concerns, geopolitical conflicts, and inflationary pressures weighed heavily across the globe. 2022 opened with ongoing supply chain and production disruptions from the Covid pandemic which were sharply worsened by the February invasion of Ukraine by Russia. The Ukrainian conflict also led to a sharp increase in already elevated energy prices. This rise in petroleum prices was a major component of the surge in global inflation experienced during the year that in turn triggered aggressive monetary tightening by most of the world’s central banks.

In the U.S., the Federal Reserve hiked interest rates by 0.75 percentage points in four consecutive meetings before finishing the year with a ‘pared back’ 0.50 percentage point increase in mid-December. The final hike brought the fed funds rate to 4.5% – its highest level since 2007. Looking forward, Fed officials have signaled their strong intention to lift the overnight interest rate above 5% in 2023 and keep it there for the entire year. Indeed, recent communication from the Fed has been almost exclusively hawkish (i.e., biased towards raising interest rates) including comments in early January from two senior Fed officers suggesting that rates will remain ‘higher for longer’ so as to fully combat stubbornly high inflation. As we commented upon last quarter, Fed Chair Powell went on record stating the central bank’s sole objective for the foreseeable future is to return to the inflation target of 2%. Despite the central bank’s recent actions and comments, a meaningful stock rebound in the year’s fourth quarter signaled markets remain broadly optimistic that inflation, and in turn interest rates, will begin to fall meaningfully in the second half of 2023. Recent moves in the financial markets appear to be wholly inconsistent, as well as out of sync, with the Fed’s current policy and tone. In our view, this is a major disconnect that should give investors cause for reflection: as the adage goes, “Don’t Fight the Fed!”

At the same time, considerable challenges to growth remain on the horizon, and OECD projections for global growth in 2023 have been cut markedly – now standing at 1.7% – down significantly from projections of 3.0% as recently as last June. Per Bloomberg, recession in the coming year appears to be the default scenario, perhaps the most widely anticipated in recent times. Barclays Capital believes the year may go down as one of the worst for the world economy in four decades. In the U.S., layoffs are sweeping the corporate world particularly in the technology and financial sectors. Within the last two months, Twitter has fired half of its workforce while META, Amazon, and Salesforce also announced substantial cuts in headcount. In the financial sector, Goldman Sachs made meaningful cuts in January with other major banks likely to follow suit. A large majority of Americans, 70% according to a Magnify Money survey, are worried about recession in 2023. A more troubling concern is that a global economic downturn would likely be accompanied by persistently high inflation, creating the possibility of a temporary stagflationary economic environment. A recent Bloomberg survey of professional money managers indicated that roughly 50% believe stagflation is the most likely scenario for the global economy this year. We, too, unfortunately believe that 2023 will prove to be a time of severe economic challenges.

… WITH DRAMATIC CONSEQUENCES FOR GLOBAL FINANCIAL MARKETS

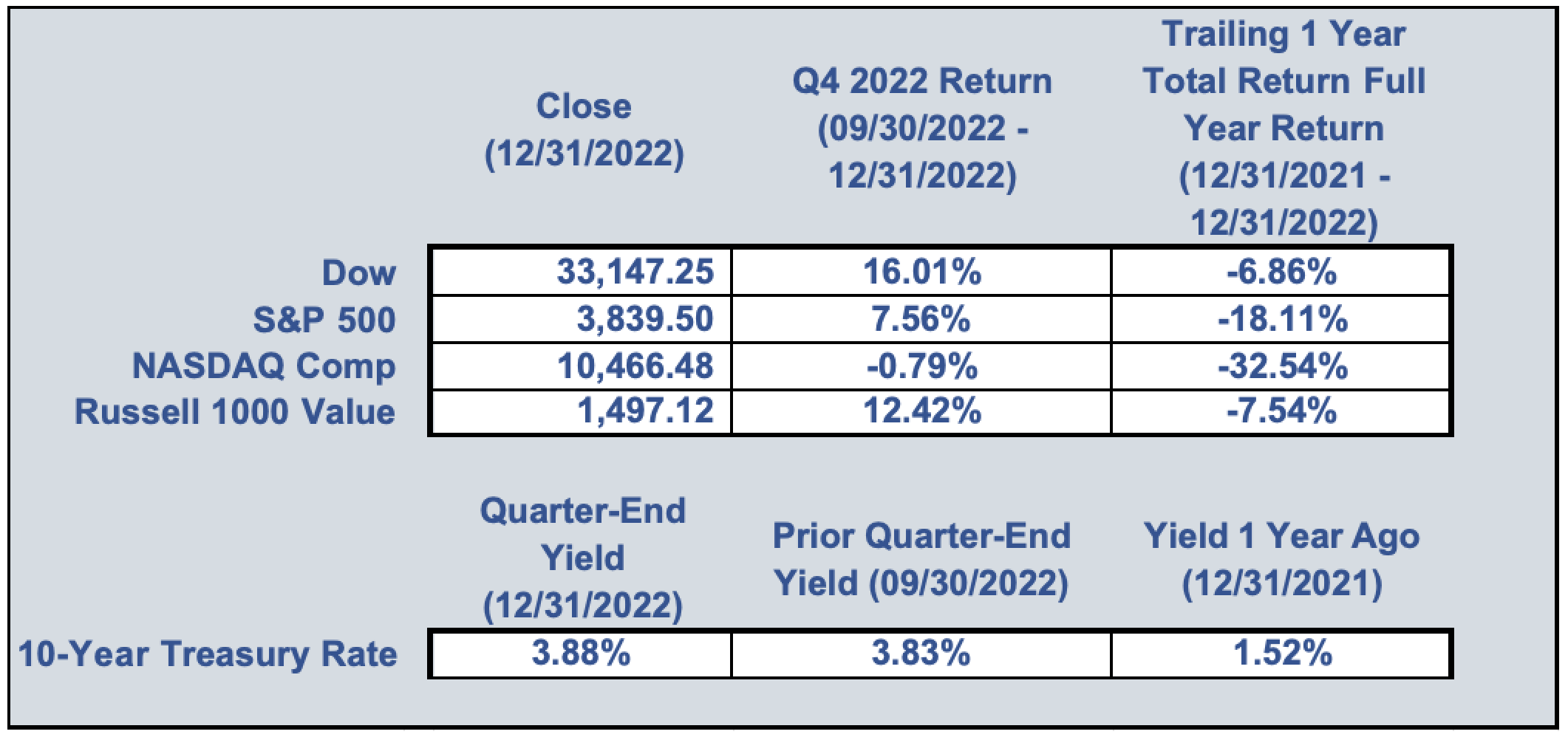

To cap off a highly volatile 2022, global stocks rebounded sharply in the fourth quarter. After three consecutive quarters of negative returns, the S&P 500 was up 7.6% in Q4, bringing the calendar-year return to -19.6%. Likewise, the Russell 1000 Value returned 12.4% in Q4, bringing its calendar-year return to -7.5%. Days with sharp reversals in investors’ risk-on/risk-off appetite dominated behavior in most market segments, with most of the quarter’s positive returns coming in November. Market gains were driven primarily by positive sentiment related to indicators suggesting inflation could be cooling. However, we believe that the superficially positive data is misleading investors on the likely trajectory for inflation. Energy stocks had especially strong returns during the quarter with sector heavyweights Exxon and Chevron posting record profits.

After a strong rise in the year’s first three quarters, bond yields held steady in the fourth quarter despite continued monetary tightening. Risk premiums in bond markets shrunk through the year’s closing quarter as investor sentiment continued to be positive. However, the overall bond markets, as measured by the Bloomberg US Aggregate bond index, had one of the worst years in the last century as they declined in excess of 13% in 2022. The uncharacteristically strong relationship between stocks and bond returns continued in the quarter and remains a concern heading into the new year. For 2022, cash and commodities were the kings and ended up being the only safe havens across the asset spectrum.

WHERE ARE THINGS HEADED MOVING FORWARD?

As the first quarter progresses, all eyes will be on new inflation data, jobs reports, quarterly earnings, and perhaps most importantly, any change in communication from the Fed. Overall, we believe markets are overly optimistic about how quickly and painlessly the Fed will pivot to an easing monetary policy. Again, there have been no dovish signs from the Fed whatsoever for many months.

Rather, the Fed has been extremely consistent in its communications to the contrary, i.e., that rates will continue to increase – very likely above 5% in 2023 AND stay at these levels at least through year-end. While the rate of inflation may begin to cool as the year progresses, we believe there is a long road ahead before the U.S. central bank will feel comfortable to start moving off of its loudly announced anti-inflation campaign. The Fed has, to date, made clear that even if this inflation battle results in sharp pain to both the economy and our nation’s workers, its current policy will be maintained.

Given the issues discussed above, we believe that market volatility is likely to remain elevated. Although some of these concerns have been priced into markets, our view is this repricing has not been sufficient to present compelling valuations in many sectors. In this environment, we plan to tread with caution, to remain disciplined in both asset allocation as well as security selection, and to be slower to deploy cash reserves than we have historically. Nonetheless, we continue to believe it to be vital for investors to stay the course with their existing portfolio strategies – especially in these uncertain times.

If you have any unique concerns or issues that we can help you handle during these tumultuous times, do not hesitate to reach out to us. Hoping that this letter finds you and your loved ones healthy and happy this New Year!

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |