Fed’s Fable? Untangling a Tale of Diverging Perspectives…

In the aftermath of a first quarter marked by persistent inflation, unsettling economic data, narrowly generated market returns, and an abrupt and destabilizing banking crisis, the second quarter proved to be more positive, at least on the surface. While the banking system is by no means out of the woods – indeed many regional banks continued to struggle in the spring quarter – the backstops provided by the Fed and Treasury together with capital infusions from larger global banks appear to have steadied the financial sector. Meanwhile, consumer price inflation, after remaining almost unchanged in April, showed signs of improving as the quarter progressed, falling from 4.9% in April to 4.0% in May and then 3.0% in June. After 15 months of consistent rate hikes, the Fed opted to pause its tightening cycle at its June meeting, partly in response to falling inflation, and partly “to evaluate the effects prior rate hikes have had on the economy so far.”

Despite the pause in rate increases, and real progress fighting inflation, there is every reason to expect additional monetary tightening over the second half of 2023, and perhaps into 2024. For one, core personal consumption expenditures (PCE), the Fed’s preferred inflation gauge excluding energy and food prices, remains stubbornly high at 4.6%. Unlike other measures of inflation, core PCE actually increased in April, and only declined 0.1 percentage points from April to May. In recent remarks to Congress, and at June’s global conference of central bankers, Fed Chair Powell reiterated his perspective that interest rates will need to move higher to contain continued price pressures. He indicated the timing of additional hikes will be based on incoming economic data, and that the Fed remains committed to a 2.0% inflation target – a position consistent with effectively all other recent communication from US central bankers. Moreover, data from the Fed’s June meeting suggested a high likelihood of at least two additional rate hikes this year.

It is important to emphasize that once the Fed ends its current tightening cycle, interest rates are unlikely to be cut anytime soon. History has shown that inflation can be notoriously fickle when it begins its descent and is prone to spike up sharply if it does not reach a stable and low baseline. In this context, and given that core inflation is coming down from such a high level, several quarters of an extended pause are likely to pass before monetary policy shifts into an active “easing” cycle of interest rate reductions. In this vein, looking more closely at the data, there have been some strong signs that the economy is continuing to heat up in certain sectors, while productivity numbers remain a concern.

Most notably, the US added nearly 500K jobs in June based on ADP employment numbers, well above forecasts of 228K. While this number surpassed expectations in April and May, the magnitude of the jump in June was surprising and sent the markets into a sharp selloff on worries this jobs data would alarm the data-driven Fed. Compounding this concern, the increase in employment occurred in an environment of declining productivity; nonfarm labor productivity fell by 2.1% in the first quarter, marking the fifth consecutive quarter of contraction on a year-over-year basis. The ongoing reduction in labor productivity represents the longest period of decline since the data started being collected in 1948. In addition, and perhaps most importantly, wage growth remains robust with a 4.4% year-over-year increase in June. When factored together, these trends suggest the economy remains overheated and will give the Fed ample reason to resume a tightening regime in the near future.

Running with – or From – The Bulls?

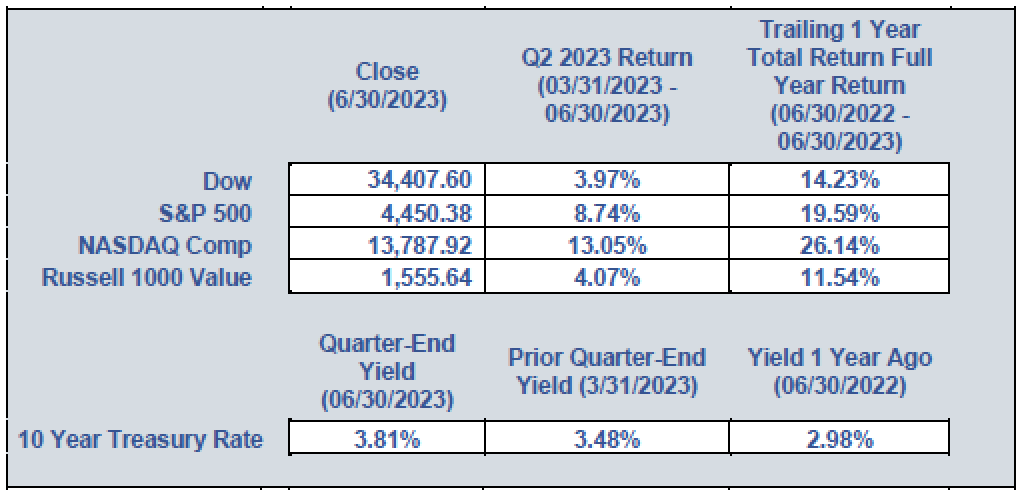

US stocks charged into bull market territory in the second quarter, as the S&P 500 rose 8.7% marking three consecutive quarters of positive returns and a 20.0%+ rally from its 2022 nadir. Continuing a trend from the first quarter, the Russell 1000 Value lagged the S&P by a wide margin, posting a 4.1% return, as the technology, consumer discretionary, and communications services sectors continued to lead the market and traditional value sectors like utilities and energy lagged. Generative AI continued to be the winning theme, causing companies like Nvidia, META, and Tesla to lead the market yet again. While returns were a bit more widely distributed than in the first quarter, the bulk of the market’s returns were still narrowly divided, as illustrated by a 6.0 percentage point gap between the third and fourth best-performing sectors in the index, communications services and industrials, respectively.

There are plenty of reasons to be skeptical of current market valuations. For one, expectations for corporate earnings do not match up with where stocks are currently priced. According to Factset, second-quarter earnings for companies in the S&P 500 are expected to report a 7.2% decline – marking the third consecutive year-over-year decline. Likewise, average net profit margins are expected to fall to 11.4% for the quarter, down from a peak of over 13.0% two years ago. As such, we see a scenario where companies are squeezed on both ends, facing rising borrowing costs while also having little room to raise prices further. After declines in earnings over the last two quarters, the second quarter earnings results will be under intense scrutiny, particularly with market valuations at such lofty levels.

Another source of concern is the magnitude of the interest rate yield curve inversion. As noted last quarter, an inverted yield curve, as measured by the interest rate differential between the 2-year and 10-year Treasuries, is a classic recession signal. The differential between these two sets of bonds increased considerably in Q1 and continued to increase in Q2 with the yield on the 10-year dropping to 1.08 percentage points below that of the 2-year Treasury – the widest differential seen since 1981. Companies with over-leveraged balance sheets, whether due to poor capital allocation decisions (as in regional banks) or excessive borrowing to fuel growth (as in the tech sector), will find it increasingly difficult to operate in this environment. As noted earlier, we do not anticipate reductions in interest rates to provide corporations or consumers relief anytime soon. In short, the market appears priced for perfection such that there is a scant margin for error to sustain current valuations.

Where Are We Headed Moving Forward?

Despite rising interest rates and two consecutive quarters of negative corporate earnings with a third likely on the way, markets have surged ahead in 2023 with the S&P up over 16.0%. As such, our belief that US stocks have grown disconnected from economic reality has only strengthened. We view the elevated level of core inflation as a substantial concern and fully expect the Fed to resume its tightening cycle this year, with at least two additional rate hikes on the horizon. While generative AI has been a boon to certain stocks, we nevertheless believe the tech-led market rally has been far overdone and does not correlate to underlying corporate fundamentals. US stocks are clearly trading at valuations that assume the Fed will quickly relax monetary policy if the economy moves into recession. We believe this scenario is inconsistent with the Fed’s stated hawkish intentions, communicated consistently over the past year.

In this environment, we believe that risks have become asymmetric and that the likelihood of a recession and a sharp market decline – potentially accompanied by lingering inflation – is meaningful. Given this view, we plan to tread with caution, to allocate defensively within equities, to remain disciplined in asset allocation, and to be slower to deploy cash reserves than we have historically. Nonetheless, we continue to believe it vital for investors to stay the course with their existing portfolio strategies, especially in these uncertain times.

As always, if you have any specific concerns or issues with which we can help, do not hesitate to reach out to us. Hoping that this letter finds you and your loved ones well and enjoying a safe and enjoyable summer season.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |