Higher-for-Longer…

To date, 2023 has been a year marked by a series of crises and varied uncertainties in both the economy and in the markets. The year started with large-scale tech layoffs and the first quarter closed amidst a banking crisis as several large US banks failed in succession. Concerns about persistently high core inflation and elevated wage growth in an environment of declining labor productivity have added an additional overhang to markets. All of this occurred as corporate earnings stagnated. Despite these issues, Wall Street roared ahead through the first eight months of the year, seemingly unphased. Heading into the third quarter, there was widespread optimism that a resilient job market together with strong consumer spending would dovetail with a move to lower interest rates to allow for an economic soft-landing. Markets appeared convinced that an anticipated shift in monetary policy—from hawkish to dovish on the turn of a dime—would be a cure-all, and stock valuations increased accordingly. While a Fed interest rate pause in June—after 15 months of consecutive rate hikes—did signal that peak short-term rates were on the horizon, the fundamental discrepancy between stock valuations and the current economic environment appeared to be based largely on a false assumption: that the Fed would begin quickly and precipitously reducing rates, thereby giving the economy a strong ‘shot in the arm.’

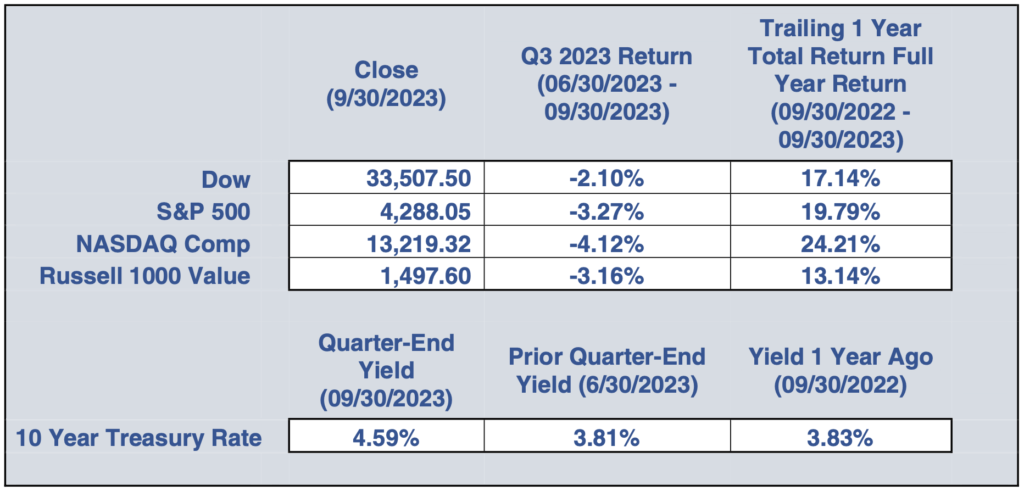

The situation shifted rather dramatically in September. While the Fed opted to pause hikes again at its September meeting, Fed Chair Powell nevertheless forcefully reiterated his position that there would NOT be an abrupt pivot to monetary easing, and that rates would stay high for as long as necessary to meet the Fed’s targeted inflation rate of 2%. Even prior to Powell’s remarks in September, longer-dated Treasury yields had begun to rise as the bond market started to reflect the inevitability of a ‘higher-for-longer’ interest rate regime. This rise in rates was further spurred on by hawkish comments from Powell and other Fed officials. By the end of the third quarter, the 10-year Treasury had climbed to 4.6%. By early 4th quarter, rates exceeded 4.9% – the highest level since 2007. Not surprisingly, the stock market followed suit. After racking up substantial gains through the first two quarters, stocks were down meaningfully in Q3.

To further complicate the picture for US markets, several global macroeconomic themes came into prominence in the third quarter. Energy prices rose to a ten-month high in late September as global Brent crude topped $95/barrel for the first time since November 2022 – thereby further fueling inflation. Supply cuts from the OPEC+ nations tightened the oil market with Saudi Arabia’s energy minister declining to take any action to reduce prices. The tighter oil market has led to predictions that $100/barrel oil could again be on the horizon. Apart from spurring added inflationary pressure — and more reason for the Fed to consider additional monetary tightening — the 20%+ rise in crude oil since late summer will likely harm the global economy, erode fuel consumption, and put additional pressure on the financial markets.

Another key trend in the quarter was the growing risk in China of a significant economic slowdown after decades of supercharged growth. A much-anticipated post-pandemic recovery appears to have subsided with data showing warning signs across the economy. There is concern that the Chinese government’s traditional tools for reversing course may not be viable options in this environment. Complicating the picture is the fact that there are major challenges across commercial and residential property sectors, sluggish consumer spending, and enormous levels of local municipal debt. Accompanying this economic stagnation has been a heightening of political tensions between the US and China, something that will bear watching as we head into 2024.

On the currency front, the dollar is strengthening again as growth has faltered in China and Europe. In September, the US currency rapidly reversed its declines from July, upending bets on a pullback based on the prospect of an end in Fed rate hikes. Now, the dollar’s revival is evoking memories of last year when the U.S. currency delivered economic shocks by pushing commodity prices higher in global markets and increasing the burden of foreign debts denominated in dollars.

…Means Stock Valuations are at Risk

After three consecutive quarters of strong returns — amounting to a 20.0%+ gain from 2022 lows — US stocks, as measured by the S&P 500, reversed course in the third quarter, retreating 3.2% including a 5.3% drop in September. Having lagged the S&P in the first half of the year, the Russell 1000 Value performed slightly better for the quarter as the energy sector climbed on sharply higher petroleum prices. In contrast, the secular trend of tech dominance ended abruptly as the Nasdaq was down 4.1%, and several of the AI-theme stocks that had led driven the market’s rise in the year’s first half took sharp losses during September’s market decline.

In an environment where stocks have been priced for perfection, concerns over rising Treasury yields together with an expectation that rates will remain higher for longer were the main drivers of the recent market drop. As we have stated in past newsletters, fighting the Fed is an unwise proposition, and Powell’s message is now being heard loud and clear by markets. Taken together with rising oil prices, stagnating growth in China and Europe, concerns about a government shutdown, and broader geopolitical strife, the relatively swift decline in markets at the end of the quarter was not surprising. The question looking forward is how much further do stocks have to fall before a ‘higher-for-longer’ scenario is fully priced in?

As noted previously, the magnitude of the yield curve inversion has been extreme with the spread between 2-year and 10-year Treasury yields at its widest differential since 1981 at the end of the second quarter. Historically, a sharply inverted yield curve has been a classic recession signal, and true to form, the ‘unwinding’ of this extreme inversion is now playing out with meaningful consequences for the markets. In short, the spike in bond yields over the last few weeks of the third quarter was accompanied by an abrupt ‘reversion’ to mean. The curve was inverted by almost 1.1 percentage points as recently as July; now, that number has fallen to a little more than 0.3 percentage points – the lowest level of inversion in the last year. An additional concern is that the main catalyst for this reversion has been a sharp increase in long-term yields, known in finance lingo as a ‘bear steepening.’ According to Capital Economics, a provider of independent market research, such shifts in the shape of the yield curve have generally been followed by significant falls in equity indices. As such, and given the other risks mentioned above, we believe there is still considerable room for a stock market correction ahead.

Where Are We Headed Moving Forward?

While historically October has been a positive month for stocks, we remain concerned about risks for the remainder of this year and going into next year. The major risk factors that markets faced in September — sticky inflation, elevated oil prices, higher-for-longer rates — are all still on the table, and many trends in the world economy continue to worsen coupled with an increasingly tense global geopolitical picture.

In this environment, we believe that risks remain asymmetric, and that the likelihood of recession and a sharp market decline – potentially accompanied by lingering inflation – is meaningful. We continue to be generally underweight equities with an emphasis on more defensive securities in the asset class. In the bond space, we are now lengthening our average bond life as interest rates have hit 15-year highs.

All the same, we continue to believe it is vital for investors to stay the course with their existing investment strategies, especially in these uncertain times. As always, if you have any specific concerns or issues with which we can help, do not hesitate to reach out to us. Hoping that this letter finds you and your loved ones well and enjoying a safe and enjoyable autumn.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |