‘VICTORY’ OVER INFLATION OR PREMATURE CELEBRATION?

After more than a year of disconnect between bullish broad market sentiment and overtly hawkish Federal Reserve commentary and policy, the December FOMC meeting appears to have been an inflection point in the central bank’s inflationary fight. While Chair Powell and other officials had repeatedly and steadfastly pointed to the dangers of inflation in prior meetings—even after the Fed had halted its hiking cycle in favor of an extended pause—they took a decidedly different tone in December. In its summary of economic projections, including the infamous dot plot which maps out policymakers’ expectations for where interest rates could be headed next year, the Fed had a median expectation of 0.75 percentage points of rate cuts in 2024. This was considerably more dovish than the 0.25 percentage point reduction forecast in the September meeting.

Moreover, and perhaps most surprisingly, Chair Powell’s remarks accompanying the decision to pause for a third consecutive meeting were equally dovish as he acknowledged for the first time the committee’s discussions about future rate cuts. In addition, he appeared to emphasize the progress made toward the Fed’s 2% inflation goal rather than the difficulty of the ‘last mile’ in battling inflation as had been the case in prior remarks. With each question Chair Powell received during the press conference, there were opportunities to take a hawkish tack, but Powell repeatedly erred on the side of optimism. While these remarks were heavily qualified and context dependent with plenty of discussion about inflationary risks remaining sticky, the overall tenor of the meeting—and the notable difference from past remarks—was enough to send markets into overdrive and commentators declaring victory over inflation. As Bloomberg economists summarized it, “the FOMC showed a surprising willingness to endorse market pricing of rate cuts. The latest forecast reflects a total embrace of the soft-landing scenario.”

Of course, it is completely reasonable to question the soundness of the market’s soft-landing conclusion and the prevailing notion that the fight against inflation is now effectively won. It is worth noting that there have been very strong consensus opinions at the close of each of the last three years that have not panned out: in 2023, the view that recession was inevitable; in 2022, the thought that large tech companies would be immune to higher rates; and prior to that in 2021, a conviction that paying up for expensive stocks was fully justified. This year, the overwhelming consensus appears to be that the economy is heading for a soft landing and that interest rates will move down in a significant way.

Futures markets, per the CME Fedwatch tool, are now baking in a 55% chance of a rate cut by March, and markets are currently pricing in expectations of five or six cuts in 2024. Even some banks and strategists that took a soft-landing outlook weeks or months ago are now having to reassess their market forecasts for next year as stock valuations have risen sharply from October lows. As of this writing, the S&P is up almost 14% from its October nadir, the Ark Innovation ETF is up over 45%, and the bank and real estate sectors are up 26% and 20%, respectively. So, even with a dovish shift in Fed tone, and assuming a best-case soft-landing scenario for 2024, it would seem prudent to at least question whether most, if not all, of the near-term ‘justified’ upside for stocks has already been realized.

A strain of skepticism about market euphoria is particularly compelling when considering the manifold risks still present in the global economy: lingering inflation in the US; geopolitical conflicts with the potential to escalate, notably in the Middle East, Ukraine, Red Sea, and South China Sea; potential for rate hikes in some geographies, primarily Japan; and lackluster corporate earnings growth in the US and abroad. Regarding inflation, as Powell noted consistently at every press conference since July until his December pivot, bringing inflation down to the Fed’s 2% target would require weaker growth and hiring. After the November inflation print, many commentators suggested that the results would make it harder for the Fed to consider a rate reduction in the near future. While the ‘cost-push’ component of inflation has indeed declined, the ‘demand-pull’ component is much stickier and will account for much of the ‘last mile’ of the battle to bring inflation down to the targeted 2%. Of particular concern, core inflation most recently ticked up 0.3% on a month-over-month basis, remaining at 4.0% annualized. As we have noted, history has proven time and again that inflation can spike up sharply if not held in check for an extended period.

SHIFTING FROM FEAR TO GREED…

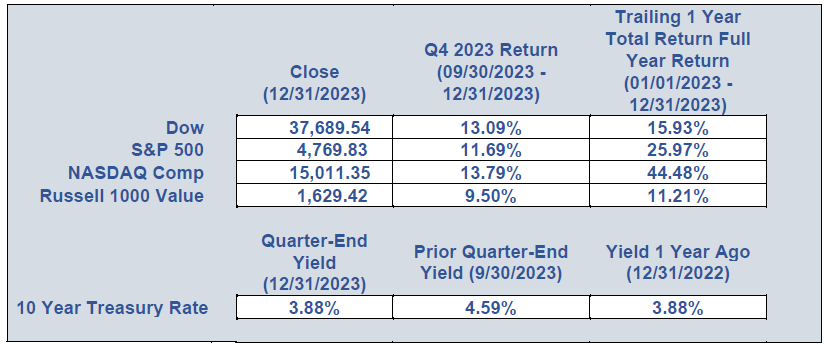

Having reversed course in the third quarter with a 3.2% decline, US stocks began the fourth quarter with a continued downward slide. The S&P 500 continued to fall through late October, and markets appeared to be bracing for a ‘higher for longer’ environment as elevated interest rates, mixed earnings, and heightened tensions in the Middle East took a toll. What followed was one of the sharpest short-term rallies in the history of the markets. Stocks initially jumped in early November on news that October inflation figures came in slightly lower than consensus forecast. This news was accompanied by signs of economic slowing and a growing view that the economy would fall into recession, potentially prompting a quick pivot in monetary policy.

While the pace of gains slowed in early December, the market rally continued on growing hopes of multiple interest rate cuts in 2024. Finally, in the wake of a December Fed meeting projecting a surprisingly dovish tone, markets shot into overdrive and continued to ascend, approaching all-time highs. Notably, the November/December rally was much broader in scope than the narrow, tech-driven gains of the first half of the year. Rate sensitive sectors helped to lead the market, as real estate, utilities, financials, and materials sectors were all up meaningfully. Likewise on the bond side, Treasury yields retreated dramatically: after approaching 5% in mid/late October, 10-year Treasury yields fell to 3.85% in late December.

Another data point worth evaluating is the CBOE Volatility Index (VIX), a gauge of implied volatility in the stock market. In mid-December, the VIX reading fell below the critical thirteen threshold (generally considered the low-end of a normal range), reaching its lowest level since before the pandemic lockdowns of 2020. The current low reading suggests markets have shifted from fear to greed in a big way, and that a meaningful resumption in IPOs, new bond issues, and increased lending from banks is likely. All in all, there are technical tailwinds that drove the markets upwards for an end-of-year romp, but can this momentum be sustained over into the new year?

WHITHER STOCKS IN 2024?

While an extension of market euphoria could be in store for the late winter, we remain concerned about risks on the horizon. For one, stocks are now pushing up against technical resistance levels as the S&P and other indexes near all-time highs. Moreover, as we highlighted earlier, there is no shortage of significant risks in the global economy, including sticky core inflation, heightened geopolitical conflicts, declining corporate profits, and—notwithstanding the ‘soft landing’ consensus—a very real possibility of prolonged recession.

In this environment, we believe risks are asymmetric, and that it is vital for investors to stay the course with their existing investment strategies, especially in these uncertain times. As always, if you have any specific concerns or issues with which we can help, do not hesitate to contact us. Hoping that this letter finds you and your loved ones well and enjoying a safe and happy New Year.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |