HIGHER FOR LONGER, BUT DOES IT MATTER?

Stubbornly persistent inflation pressures continued in March, likely derailing the case for the Fed to begin reducing rates in June and also raising questions as to whether rate cuts can be implemented this year without sign of an economic slowdown. The last mile, or in this case, the last percentage point, is often the hardest part of a long hike. For the Federal Reserve, its 2.0% inflation target remains in sight but despite a slow slog forward, it remains persistently out of reach.

Early April’s blowout US jobs report convinced many of the American economy’s continued resilience. According to the US Department of Labor, payrolls swelled by 303,000 in March, sharply topping the consensus estimate of 205,000. Meanwhile, the unemployment rate edged lower to 3.8%, wages grew at a solid clip, and workforce participation rose – all underscoring the labor market’s strength. The Fed’s most recent projections show the economy this year growing by a solid 2.1% with the year-end jobless rate to be 4.0%, close to 50-year lows.

Highlighting the “stickiness” of inflation, April’s CPI report showed a 3.8% year-over-year increase, the highest level in six months. The bigger than expected bump in the consumer price index was largely due to higher housing and gasoline costs. The figure marked the third month in a row that core CPI topped forecasts, sparking concerns that rate cuts are less likely, and that inflation has become more entrenched. However, the most recent prints from the US core PCE, i.e., the Fed’s preferred inflation gauge, rose a more modest 2.8% through February end, lower than the prior month and appreciably below the 4.8% reading of the prior year. Yet, this reading too remained appreciably above the Fed’s 2.0% target.

WHERE DOES THIS LEAVE THE FED?

Until recently, Fed Chair Powell had stated his belief that the central bank would reduce rates three times in 2024. However, this position had the caveat that any rate decision would be highly data dependent. In the face of the newest inflation and jobs prints, it is unclear how much Mr. Powell’s position may have changed. In response to high inflation data in January and February, the central banker had characterized the higher readings as the result of “bumps.” There have now been three so called “bumps” in a row.

The markets in recent days have spoken strongly following the unexpected CPI reading and strong jobs report. After a sharp move in 10-year Treasury yields, the CME FedWatch tool is now projecting less than a 5% chance of a rate cut in June and only two rate cuts before the end of the year. In fact, hawkish Minneapolis Fed president Neel Kashkari stated his belief that there may not be any rate cuts at all this year if inflation progress remains stalled.

Given the recent resiliency of the labor market and above estimate inflation readings, some analysts have started to espouse a similar position as well – a far cry from Wall Street’s December expectations of six or seven rates cuts in 2024.

The multi-trillion-dollar question at hand is whether the surprisingly strong U.S. economy can continue its expansion despite the record increase of interest rates over the last 24 months. Policy makers are trying to strike a delicate balance as they contemplate how to respond to the economic moment. Central bankers do not want to risk tanking the labor market and causing a recession by keeping interest rates too high for too long. However, they also want to avoid cutting borrowing costs too early or too much, which could prod the economy to accelerate and inflation to take even firmer root. About the only certainty at the moment is that if inflation does in fact become “stuck” at levels appreciably above 2.0%, the consequences could be dire for both the dollar and the US economy.

AS THE EQUITY MARKETS CONTINUE TO RISE…

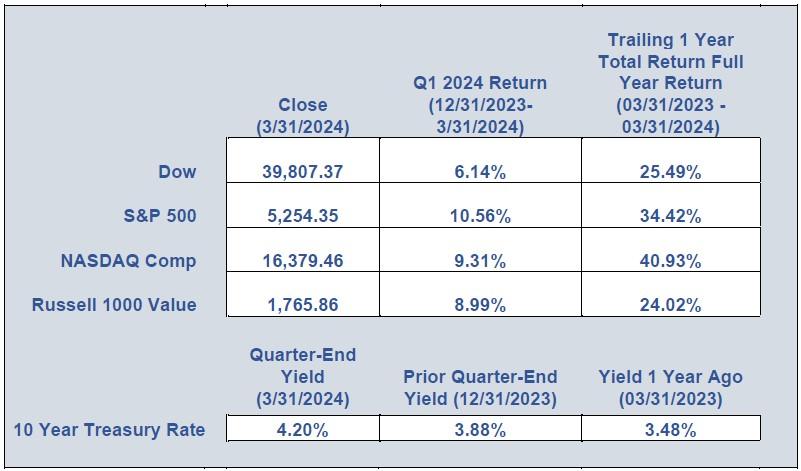

After the fireworks of New Year’s Day subsided, markets continued their late Fall rally on the back of expectations for sharp interest rate cuts in 2024. Wall Street closed out the quarter with most US indices at, or near, record highs as the AI stock trend continued to dominate the markets. However, as the mid-March rate cut scenario faded, investor focus shifted to the resilient economy with less attention on delayed rate cuts and more on robust economic growth.

To date, mega cap tech stocks have largely powered the benchmark S&P 500, Rusell 1000 Value, and Nasdaq Composite to recent records. AI driven hopes for Google and Meta caused the communication services sector to be the quarter’s market leader with gains of 14%+. On the other hand, the real estate sector was the laggard as it posted modest losses, largely on the back of higher interest rates.

Wall Street strategists will be closely following the first quarter earnings season in an attempt to identify a pickup in areas outside of technology. Meanwhile, the consensus for profit growth of the S&P 500 companies is only 3.9% – the smallest since 2019. However, forecasts could turn out to be overly gloomy – like they were in the fourth quarter, when expectations were for around 1.0% growth and the actual results turned out to be over 8.0%.

One continued boost to corporate earnings has been the ongoing splurge by companies on share repurchases – projected to be more than $1.0 trillion this year. Of potential concern is that buybacks combined with dividends are now more than fully consuming companies’ free cashflow. In turn, this has resulted in the need for additional corporate debt. According to FactSet, the amount of corporate leverage has ticked up to ~1.9 times debt to cashflow. While still manageable, leverage above 2.0x would start to reflect greater corporate financial risk.

Looking at the fixed income market, bond yields gradually rose during the quarter as signs of a stronger than expected economy emerged. But then, yields on the 10-year Treasury surged in early April to ~4.6% – spooked by the latest hot CPI reading – although they remain well below the October peak of 5.0%. However, the recent rise in yields does not capture the full picture as the intermediate to longer-term rate picture remains clouded by the ongoing and elevated U.S. budget deficits. With a projected 2024 Federal deficit of more than 7.0% of GDP, a level unheard of outside of wartime or recession, there is currently no path towards a more balanced spending plan.

Per Congressional Budget Office projections, net debt held by the public is projected to increase from 99% of GDP at year-end 2024 to 116% in 2034 – the highest level ever recorded, even higher than after World War II. Although the dollar remains the world’s reserve currency, this exalted status could disappear quickly if the growth of America’s debt continues its current trajectory. In the near term, we have concerns over the likelihood of the market continuing its recent advances. Using the cyclically adjusted P/E ratio, or CAPE, the market would currently be considered overvalued. Historically, this metric’s record high was 44.1, a record achieved during the peak of the Dot-Com bubble. The prior high was in 1929 when the CAPE hit 31.5. The CAPE now stands at an excess of 34.0.

WHERE DOES THIS LEAVE US MOVING FORWARD?

Uncertain, although the market can certainly stay overvalued longer than investors anticipate. What does remain crystal clear to us though is the importance of sticking to one’s investment strategy through both good and bad markets. We strongly encourage you to do the same.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |