Is it time for the Fed to act?

After months of looking for signs that inflation has sufficiently cooled, the Federal Reserve may be on the cusp of finally seeing what it needs to start reducing interest rates. Following the Federal Open Market Committee’s (FOMC) mid-June meeting, Federal Reserve Chair Jerome Powell announced that the central bank would continue to hold overnight interest rates at a range of 5.25%-5.50% and that future changes in rates would be “data driven.” Since then, the data has started to support a shift towards a more dovish Fed position.

After the release of the most recent jobs and inflation data, interest rate futures now imply that the likelihood for a September rate cut has climbed sharply with analysts projecting a ~95% probability of a Fed rate cut occurring then. If taken, this move would represent the first rate cut since the Fed started hiking rates a historic eleven times over the course of two years from early 2022 to the fall of 2023. Critical in driving this change in the Fed’s position has been the evolving inflation picture.

In fact, the most recent Personal Consumption Expenditures (“PCE”) index, i.e., the Fed’s preferred inflation measure, showed a more modest 2.6% year-over-year increase. Meanwhile, June’s Consumer Price Index (“CPI”) reading came in below market expectations with a 3.0% year-over-year increase, and the Core CPI reading registered 3.3% growth, meeting market expectations. While inflation has not yet reached the Fed’s targeted 2.0%, this trend of slowing price increases is increasingly encouraging.

Employment, too, has cooled down in recent months. After hitting record, non-war, lows of 3.4% in early 2023, unemployment has grown increasingly less tight over the last 12 months. The Labor Department’s June release reported unemployment at 4.1% – the first time it has exceeded 4.0% since June 2021, and up by 0.5 percentage points over the last year. While by no means definitive, historically, when unemployment has increased by at least half of a percentage point within 12 months, the labor market typically continues to deteriorate and culminates in recession.

The latest Job Opening and Labor Turnover Survey (JOLTS) release added further clarity to the nation’s jobs picture as it reported 8.14 million openings – a modestly higher than the expected reading. While the May 2024 reading of employees willing to leave their jobs, called the quit rate, remained unchanged at 2.2%, it is now near a more typical historic level – thereby suggesting that wage inflation should continue to moderate.

Looking at the broader economy, growth appears to have modestly slowed. After U.S. gross domestic product (GDP) grew by 2.5% in 2023, the first quarter’s growth was a more tepid 1.6%. Current expectations for full year 2024 GDP now stand at ~2.0%. Compared to expectations that the U.S. economy would come to a screeching halt when the Fed sharply hiked rates, the nation’s recent economic performance has been surprisingly good. In fact, when compared to other major developed economies, U.S. growth stands out.

When taken altogether, it appears that the Fed and Chair Powell are now primed to move soon. For this dovish policy shift to occur, the next two months’ employment and inflation data must continue their current weakening trends. If the Fed were to shift to a rate cutting stance, it would bring the U.S. central bank more in line with European central bankers who cut their primary rate by 0.25 percentage points in mid-June. The vital question in any scenario is whether the Fed can navigate a slowing economy, a higher than desired, but decelerating, inflation rate and increasing unemployment rate successfully. The potential for a so-called soft landing where a U.S. recession is avoided exists, but it remains far from certain.

WHILE THE STOCK MARKET CONTINUES AN UPWARD MOVE

In the face of an uncertain interest rate environment and tentative economic situation, the broader equity markets have surprisingly continued to thrive. Looking more closely though, it has been a tale of two different markets. While the major indices are regularly achieving new highs, many of the indexes’ companies are struggling to achieve positive year-to-date returns.

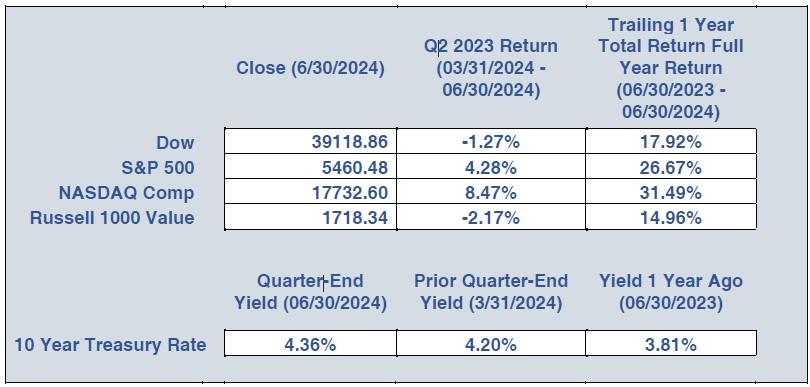

Since the markets’ most recent lows of October 2022, the S&P 500 (S&P) has gained 55%, with almost 60% of this gain attributed to the top ten stocks by market cap, per Bloomberg. Year-to-date, the S&P and Nasdaq have both generated mid-teen returns due to their exposure to these ten large, high growth companies. Meanwhile, the Dow Jones Industrials and the Russell 1000 Value have each clocked respectable single digit gains. Overall, U.S. equity markets continue to be richly valued as evidenced by the cyclically adjusted P/E ratio (CAPE) of 36.3 for the S&P, the third highest CAPE ratio ever recorded.

With current interest rates only acting as a headwinds on the stock markets, analysts have had to rely on earnings growth to support further market advances. Discounting the slowdown in GDP growth, current corporate earnings estimates forecast a strong 11.4% increase in 2024 and are up modestly from an earlier April estimate. However, given the market’s recent advances, much of 2024’s earnings growth appears to already be factored in. Further, with the market’s so-called fear gauge, the CBOE volatility index, remaining close to record lows, there appears to be a level of complacency on the part of investors. There is the potential that this market environment could be more prone to downside risk in the near-term rather than continued advances.

Moving to fixed income markets, the Treasury market remains inverted where short-term debt is paying more than long-term Treasury bonds. Historically, inversions have been a reliable predictor of recessions, and have occurred in the lead-up to almost all recessions since 1955. However, with Treasuries having been inverted since early July 2022, a recession has yet to occur.

Some say that the unusual circumstances of the current environment, including fiscal stimulus and zero interest rates, may explain why the inversion has not led to a recession. Others say that the length of the inversion is irrelevant as a recession predictor. In any case, we continue to view the yields from intermediate term bonds to be attractive, even if lower than short-term rates. If in fact the U.S. central bank does start lowering rates, it will have impact on interest rates across all maturities, not just overnight investments.

Today, cash placed in money market funds provides a 5%+ annual return and is almost risk-free. These funds have not seen yields at these elevated levels since before the Global Financial Crisis in 2008. Thus, money markets again represent a reasonable investment alternative to bonds and stocks as opposed to in early 2022 when they provided less than a 0.10% annual return. While we have increasingly availed our clients of this asset in recent quarters, when the Federal Reserve does begin cutting rates, expect to see money market yields fall, potentially quickly.

Looking a little further on the horizon, we will be keeping a close eye on any additional messaging from Chair Powell regarding the potential September rate cut. Additionally, we will be monitoring the national election as Fall is fast approaching. The recent despicable assassination attempt on former President Trump has only further heightened political tensions. Following this horrific act, polls seem to be suggesting a higher likelihood of a new Trump Administration in January.

That being said, the next few months should provide the conclusion to a number of important storylines affecting the markets. Amidst all this uncertainty, we continue to emphasize the importance of developing an appropriate investment plan and sticking with it – no matter the short-term market disruptions. If you have any concerns or issues you need to share, please do not hesitate to reach out to us. Hoping that you are enjoying your summer months!

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |