Continued Inflation, Ongoing Supply Chain Disruptions, and War in Ukraine

As we started 2022, the markets were focused on how global central banks, including the U.S. Federal Reserve, were going to address elevated inflationary levels and ongoing supply chain issues. Outside of Russia’s Putin, no one would have thought that by mid-quarter, the world’s attention would shift dramatically to the unprovoked invasion of Ukraine. While horrific in its own right, the invasion further exacerbated inflationary pressures – oil prices initially spiked by 30%+ and food prices soared as Russia and Ukraine collectively provide 20-30% of all global wheat and corn exports. The first quarter of 2022 was already troubled prior to the Russian invasion as investors focused on rate hike concerns as global central banks started moving to unwind their recent easy monetary policies. In fact, in the face of the most recent inflation reading of 6.4% using the Federal Reserve’s preferred PCE index, the U.S. central bank carried out in mid-March its first rate increase in three and one-half years to a targeted 0.25-0.50% overnight yield.

The ongoing robust job market has helped provide the Fed with additional policy flexibility in its monetary tightening with unemployment near record lows at 3.6% and with employers adding 400,000+ workers for the 11th month in a row – setting a new job growth record. Concurrently, initial unemployment claims have fallen to a 5-decade low even though the employment force is now twice as large as in the late 1960s. However, one continued concern is that the labor force’s participation rate of 62.4% which remains appreciably lower than the early 2000s’ levels of 67%+; this indicates that almost 5% fewer work-aged Americans are employed or seeking employment, thereby further exacerbating the current worker shortage.

Even if the currently strong employment market were to be crushed by sharply raising rates, and a recession were to result, the Fed still needs to gain further control over the recent burst of price increases before an inflationary mindset becomes embedded in the national psyche. Although an imprecise foreshadower of recessions, the interest rate yield curve has recently become briefly inverted, i.e., long-term rates being lower than intermediate term rates, on several days. While an imperfect indicator at best, the yield curve inversion has heightened recessionary fears amongst both analysts and economists. Also, of additional concern, consumers sharply stepped back on their spending in mid-winter to 0.2% in February, an extremely modest annual increase compared to the norm of 2%+. Nonetheless, barring any additional bad news, we are cautiously optimistic that the Fed and the U.S. economy can navigate the current turbulence without falling into recession.

IN THE FACE OF UNANTICIPATED TURMOIL, THE MARKET SUFFERED ITS BIGGEST QUARTERLY LOSS IN 2 YEARS

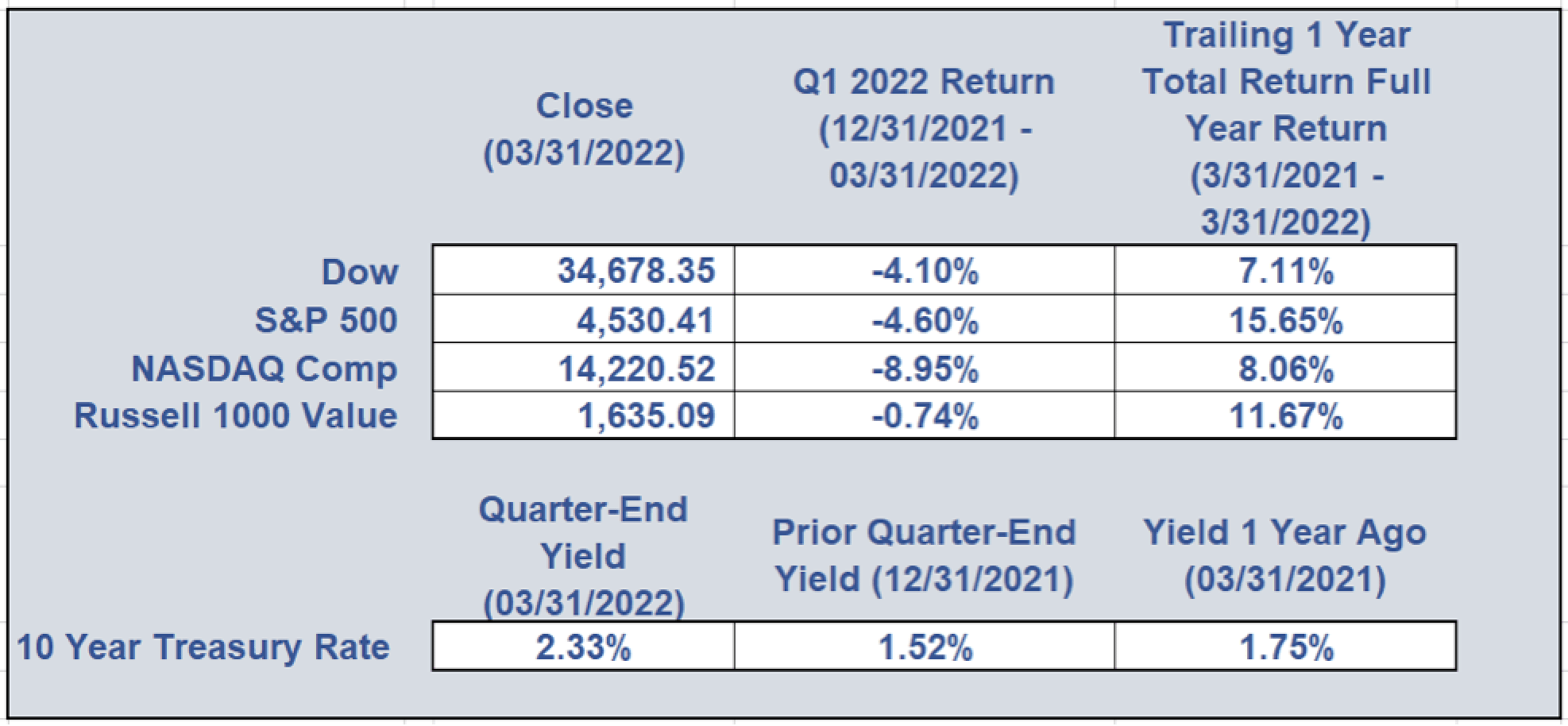

Although the Russell 1000 value snapped back from its winter lows to show less than a 1% loss in the year’s first quarter, the S&P 500 suffered a 4.7% loss for the period with the tech-heavy Nasdaq suffering an even more severe decline of close to 9%. The primary driver of this market retrenchment was investors discounting the higher growth of S&P and NASDAQ’s earnings more severely in the face of continued levels of elevated inflation. As we seek market leaders, we need to look no further than the recently anemic energy sector. With crude oil surging more than 30% for the quarter and being up by almost 65% at one point during the initial stages of the Russian invasion, the sector advanced by almost 40% over the period. The market’s laggard has been communication services which suffered a 12% decline through the double-whammy of a combination of revised privacy regulations and the trailing off of the COVID-era home communications and streaming boom.

Concurrent with the enormous turmoil in Eastern Europe, the rate on the benchmark 10-year Treasury bond tumbled to 1.7% in early March as investors sought a safe haven. However, the bond rose sharply to yield above 2.5% at quarter’s end as investors looked towards increasingly aggressive monetary tightening by the U.S. central bank. With this surge, 30-year mortgage rates jumped to almost 4.7 percentage points – 45% higher than at the beginning of the year. While the housing market is continuing to show substantial strength, much higher mortgage payments caused by the interest rate spike may soon put a damper upon the currently robust housing market. As of yet, there has been no respite from inflation as both food and energy prices have moved up sharply in recent weeks – largely due to the ongoing Ukrainian conflict. Another inflation metric, the CPI-U, showed a staggering 8.5% increase in March – the biggest jump in more than 40 years and far ahead of the Fed’s targeted 2.0%.

Yet uncharacteristically, analysts, who typically do not adjust full-year earnings projections early in the year, have recently raised their forecasts for the broader market for annual earnings growth in excess of 8%. These analysts’ forecasts, while reducing profit expectations for the 1st quarter, indicate the expectation of accelerating earnings as the year progresses. Wall Street appears to be holding to its near-term economic/market concerns while continuing to anticipate that an American recession will yet be avoided.

What remains to be seen and what will be interesting to watch is the shift in spending amongst the various market sectors as consumers shift their spending patterns in this high inflationary environment. Historically, the utilities, real estate, energy, consumer staples, and healthcare sectors have fared better in environments with sharply rising costs. In the current unclear environment, we encourage clients to stick with their pre-existing investment strategies while we continue our ongoing efforts to find opportunistic buying opportunities. Although current political, economic, and market conditions remain uncertain, consistent and informed investing over the long run has a proven record of success. We urge you to stay the course and as always, if you feel the need to discuss your current situation, please do not hesitate to reach out to us.

Wishing you all a healthy and happy spring from the staff at Dumaine Investments!

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 info@dumaineinvestments.com |