Between a Rock and a Hard Place…

After a year of extraordinary volatility in stock markets and historic losses in bond markets, investors might have had reason to hope for a calmer start to 2023. Unfortunately, the opposite proved to be the case as the first quarter was marked by both continued market turbulence and abrupt shifts in the economic landscape. Last quarter, we stressed the adage: “Don’t fight the Fed!” This quarter, it may be appropriate to include the addendum, “the Fed tightens until something breaks” as cracks clearly emerged in the beginning of the year. Concerns about persistent inflation, a hotter-than-expected job market, continued increases in interest rates, and uncertainty about future monetary policy set the tone for most of the quarter, only to be eclipsed by a nascent banking crisis in March. Indeed, the expansionary economic story of the first two months, albeit accompanied by an increasing probability of additional Fed rate hikes, was turned on its head late in the quarter with the collapse of Silicon Valley Bank followed with growing concerns about a potential credit crunch as the quarter ended.

In response to the failure of Silicon Valley Bank (SVB) and Signature Bank, and to quell fears of systemic bank risk, the Fed, Treasury, and FDIC all announced unprecedented measures backstopping depositors and offering additional monetary support to regional banks. While markets briefly rallied in reaction to these measures, the move was short-lived as the crisis proved to be more wide-reaching and deeper than initially expected. Credit Suisse Group (CS), the second largest Swiss bank and one of the largest European banks, took a massive reputational hit as key investors, following years of missteps by the bank, began to lose faith. Ultimately with Credit Suisse facing imminent failure, the Swiss government brokered a deal to sell CS to UBS, the country’s largest bank. As a result, a total collapse of CS was averted, and additional financial contagion avoided. While a major financial crisis appears to have been prevented, lingering stresses in the banking sector – and an attendant tightening in credit conditions – will likely remain an issue for many months to come.

Moreover, recent economic data point to a slowdown in US manufacturing activity and evidence of stagnation in certain parts of the economy. While job openings remain strong, they declined sharply in March with initial jobless claims almost 15% above forecasted levels. Mortgage applications were notably weaker, and commercial real estate prices declined by 15% on a year-over-year basis per Green Street – a real estate research and consulting firm. The ISM Manufacturing and Employment indexes were both well below consensus estimates as were factory orders. Despite these concerning economic signs, inflation has remained persistent; while it has continued to fall on a year-over-year basis, it rose month-over-month in both January and February. As such, the US economy is facing a heightened possibility of a stagflationary scenario, i.e., a recession combined with high inflation, within the next year.

…THE MARKET IS CHARTING A DANGEROUS COURSE

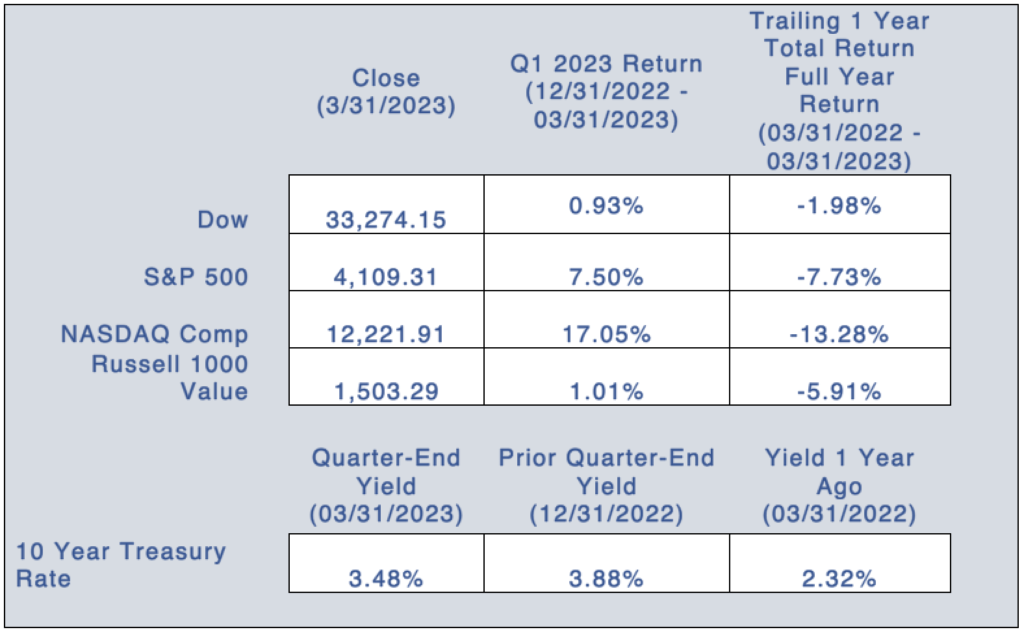

After closing out an overall disastrous 2022 with a positive note in the fourth quarter, the S&P 500 extended its year-end recovery with a 7.5% return in the first quarter of 2023. The Russell 1000 Value, however, posted only a 1.0% gain for the quarter – producing a major divergence between these two major equity benchmarks. This points to the significant disparity in returns across stock market sectors so far this year – notably between technology/communications and the rest of the market. On closer examination, the gains in the S&P were extremely narrowly based, attributable entirely to just a handful of stocks (Nvidia, META, Tesla, Warner Brothers, Advanced Micro Devices).

If these companies’ gains were to be excluded, the return for the S&P would have been effectively flat. Thus, what initially appeared to be another triumphant quarter for stocks, in the end amounted to what is known on Wall Street as “bad breath” – a signal that despite the appearance of robust health, all is not well with the equity markets. As highlighted by Bloomberg in their review of the first quarter, the divergence between the S&P 500 and its equally weighted alternative has been a key indicator in markets historically: specifically, the spread between the two tends to peak just before recessions, making the first quarter’s performance gap look ominous.

After suffering the worst annual performance in history in 2022, US bonds, as measured by the Bloomberg US Aggregate bond index, posted a 3% return in the first quarter as yields broadly fell. Arguably, the most important trend in the quarter was the increasing inversion of the yield curve, which was accelerated by the nascent banking crisis in early March. The interest rate differential between the 2-year and 10-year Treasuries reached its widest gap in over 41 years, hitting a low of -1.1 percentage points. Many analysts view this sharp difference to be a classic red flag and an indicator of impending recession. In the aftermath of the collapse of SVB, the spotlight has turned toward the creditworthiness of bond issuers, along with renewed focus on interest rate risk for financial services firms.

WHERE ARE THINGS HEADED MOVING FORWARD?

Even after adjusting for the narrowness of the year’s rally, our view remains that the stock market has grown increasingly disconnected from economic reality – particularly given recent data showing economic weakening combined with persistent inflation. US stocks are currently trading at valuations that assume the Fed will quickly relax monetary policy as the economy moves into recession. We believe that this scenario is inconsistent with the Fed’s stated hawkish intentions which it has continued to clearly communicate in recent weeks. In the wake of the SVB collapse, Fed Chair Powell reaffirmed the central bank’s dual mandate of curbing inflation while maintaining stability within the financial sector. However, he and Treasury Secretary Yellen have nevertheless both openly stated that they believe the disruption has been largely confined to a few outlier banks, and that the situation appears to have been contained. Apart from commentary that the March credit crunch represented “effectively a 25 basis-point increase in rates,” Fed officials have consistently communicated their commitment to stay the course in fighting inflation even if these actions result in painful levels of unemployment. Moreover, the minutes from the central bank’s March FOMC meeting showed a consensus among officials that they anticipate the maximum overnight interest rate to top out at over 5.0%.

In this environment, we believe that market volatility is likely to remain elevated and that most data points toward a recession and a likely downdraft in equities markets. Given this view, we plan to tread with caution, to allocate defensively within equities, to remain disciplined in asset allocation, and to be slower to deploy cash reserves than we have historically. Nonetheless, we continue to believe it vital for investors to stay the course with their existing portfolio strategies, especially in these turbulent times.

If you have any specific concerns or issues with which we can help, do not hesitate to reach out to us. Hoping that this letter finds you and your loved ones well and enjoying a happy and peaceful spring.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |