A Difficult Year for The Economy Even with Enormous Jobs Growth

2022 has been an extremely challenging year for both the U.S. and the global economy as the Covid pandemic and the Russian invasion of Ukraine have disrupted global production. The OECD is currently estimating that Russia’s invasion will cost the global economy $2.8 trillion in lost output by the end of next year, and potentially more if a cold winter leads to energy rationing in Europe. Additionally, the organization just slashed its projection for global growth in 2023 to just 2.2%, down from its prior forecast of 2.8%. It predicts Europe’s economy will be hit the hardest, but even US growth is now projected to be a mere 0.5% next year.

Compounding the global output issue, economic growth in mainland China is expected to decelerate further to only 3.3% this year amidst the country’s continued draconian Zero Covid policy. As a result, China’s output is expected to grow at almost half of its recent rate – thereby depriving the rest of the world of one its biggest growth drivers over the last several decades. A potential saving grace for the U.S. at least is that the nation’s strong labor market could result in the ongoing slowdown being “relatively orderly” according to at least one U.S. central banker. Employers have added nearly six million jobs in the past year and the current 3.5% unemployment rate at is at 50+ year lows. As things currently stand, employers continue to futilely seek new workers; there are currently more than 1.7 job openings for every job seeker. Unfortunately, the share of adults who are either working or actively looking for work is still well below pre-pandemic levels, and almost 10% beneath the economy’s highest labor participation rate which was achieved in the early 2000s. Despite the very robust jobs market, the economy has modestly contracted over the last two quarters with expectations for only very modest output growth of ~0.3% in the recently concluded 3rd quarter.

The persistently high levels of inflation, along with the Federal Reserve’s increasingly strong actions to fight the recent price surge, have been the biggest drag on domestic output. However, a resolution to the steep inflationary increase is not yet at hand as September’s consumer price index reading was up 8.2%, or almost six percentage points above the Federal Reserve’s target. Clearly, the central bank’s actions to date have not yet been sufficient in reining in prices. In September, as a result of the still unfettered inflation, the Federal Reserve raised the nation’s overnight interest rate by 0.75 percentage points for the third consecutive time to a range of 3.0%-3.25%. These moves mark the first time since the Financial Crisis of 2008 that the nation’s central bankers have had to take such drastic monetary action. In fact, Fed Chair Powell recently proclaimed that the central bank’s sole objective in the immediate future is to tame inflation. Furthermore, the market firmly expects at least another 0.75 percentage point rate increase at the Fed’s next meeting in early November – and potentially an even bigger increase could be in the works. As a result, most economists believe with a near-certainty that the U.S. economy will be in recession by 2023, if not sooner.

August’s consumption data, adjusted for inflation, showed an increase month-over-month of 0.1%; notwithstanding the faltering economy, consumers continue to spend. Helping drive this trend is the estimated $2.1 trillion in excess savings accumulated by consumers during Covid, largely due to the federal government’s multitude of spending plans enacted to counter the effects of the pandemic’s economic disruption. When compared to the ~$25 trillion annual GDP, these excess savings are substantial and continue to stoke inflationary pressures – exactly what the Federal Reserve is attempting to prevent! Some critics continue to hold to the belief that the current inflationary bout is the result of the global disruptions in trade rather than an overheated U.S. jobs market. Supporting their conviction is that prices have started to fall for a number of goods and services, including shipping, housing, and commodities. Despite these inflation naysayers, the U.S.’s central bankers are resolutely focused on ensuring a return to price stability – no matter the potentially severe effect on both the economy and workers.

… AND A CHALLENGING YEAR FOR THE MARKETS SO FAR

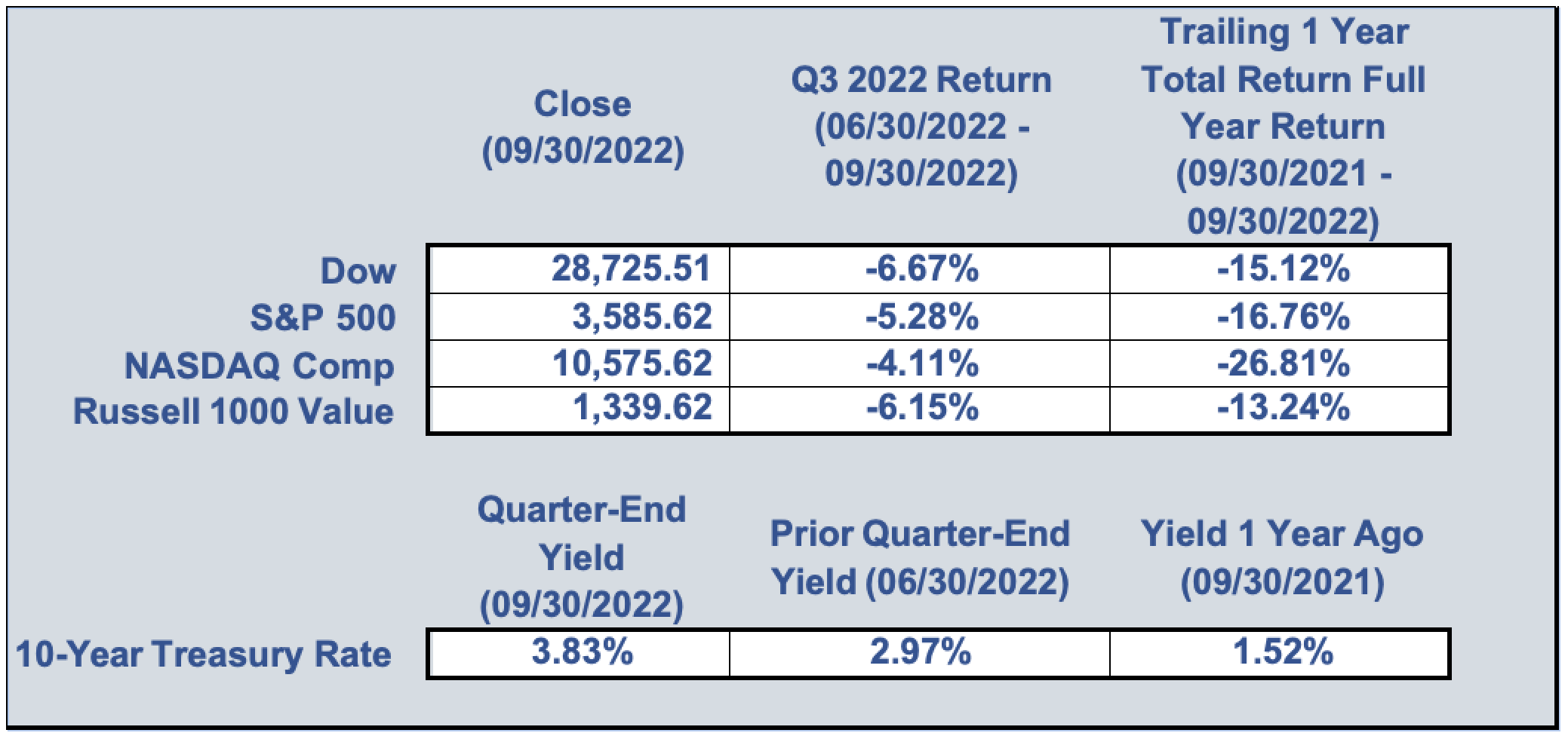

As the economy has slowed, the markets have suffered ugly quarter after ugly quarter with the broader market having now declined for three quarters – almost non-stop since the year’s start. At September-end, the S&P 500 stood 24.8% beneath its January start with the Russell 1000 Value ending the quarter down a more modest 17.8%. Unusually, no relief was found in the bond markets as the most common index, the Bloomberg U.S. Aggregate bond index, lost more than 14.5% through the end of September. This year, investors have been unhappily jolted from their slumber – a sleep largely induced by more than a decade of low-interest rates. With bond yields rising all year, investors awoke to a changed world of sharply rising interest rates, high levels of sustained inflation, and an appreciably slowing economy.

On the back of recent economic challenges, quick changes of risk-on/risk-off have characterized the markets which have fallen sharply since their early January highs. After falling into a bear market in late June, indicated by a drop of 20% from its previous high, the broader U.S. market attempted to rally until late August, when interest rate concerns again turned Wall Street south. Tech stocks are one area that have been particularly afflicted by the recent market turmoil and could see further downside risk with their hefty overseas revenues and profits being disproportionally impacted by the extremely strong dollar. Many investors think big tech profits are likely to further suffer for the remainder of 2022 and into 2023 as advertisers cut costs and consumers tighten belts. While the communications sector has led the market down with its 38%+ loss, the much larger tech sector has suffered losses of almost 31% year-to-date. On the back of sharply higher oil and gas prices, the energy sector is the only sector to have shown gains. In its case, energy has returned an impressive 32% gain year-to-date.

One of the most marked occurrences this year has been the absence of a safe haven outside of cash with even bonds, whose losses are usually limited to a no more than 5% in a given year, having declined by almost 15% year-to-date. In fact, 2022 has been the most devastating period for bonds since at least 1926, if not even longer. This ruinous period for bonds has been due to bond yields dropping close to zero during the Coronavirus Recession of 2020. When the Fed started to aggressively raise interest rates earlier this year,

bond prices collapsed. As a result, bond returns have been very closely related to those of stocks – an extremely unusual occurrence as having bond returns being so negative is a far outlier. Since 1976, diversified, investment-grade bonds have historically suffered losses in a given calendar year only four times prior to 2022 – and each time the losses were quite modest, less than 5% in a given year.

WHAT TO DO MOVING FORWARD?

Stay the course. Our clients’ investment allocations are designed to help them achieve their longer-term goals. In developing clients’ unique strategies, we take into close consideration the shorter-term market volatility that can occur within the context of the clients’ full investment time horizon. Per the market research firm DataTrek, being in the market consistently is critical. With the S&P 500 down more than 20% through early October, just 9 days made up ALL of the markets year-to-date decline. If those several trading days were to be excluded, the markets would be up 8%+ for the year! The sharply negative trading days occurred on days with either bad macroeconomic or important Fed-related monetary news. However, the flip side of this risk picture is that stocks can go up, too, and that the occasional big winning day is also largely responsible for the market’s long-term path upward.

Despite these painful days of decline, they represent part of the noise that has had the market consistently trending upwards for all of modern financial history. We believe there to be a downward bias on the stock markets at the moment since there does not appear to have been a true capitulation by investors yet, but this too shall eventually pass. However, if you have any unique concerns or issues we can help address during this tumultuous time, do not hesitate to reach out to us. Hoping that this letter finds you and your loved ones healthy and happy this fall.

| 650 Poydras Street Suite 1010 New Orleans, LA 70130 |

Office 504-521-7350 Fax 504-521-7150 [email protected] |