A re-organization of the U.S.’s, and possibly the world’s, economy commences…

Having long been dissatisfied with the U.S.’s trade imbalance and foreign trade inequities, President Trump decided to act. On April 2nd, the President’s so-called “Liberation Day” (LD) commenced a radical shift in the U.S.’s economic and trade policy by implementing sweeping changes in U.S. tariffs on imports. The move’s stated objective was to balance the U.S. trade deficit and punish countries who are perceived by the Administration to be underpricing their American exports. On April 15th, the Administration indicated that the real objective of the new tariff scheme was to economically unite the rest of the world against China. How the creation of an anti-China coalition was to be achieved through the recent tarrif action was not explained.

Please note that this letter will likely be outdated by the time it is received as the economic/tariff situation remains extremely fluid with sharp policy changes occurring daily and even hourly.

Under the current Executive action, average American import tariffs have been raised from an average of 2% to 20%. Waffling under extreme pressure from unhappy corporate leaders, sharply declining consumer sentiment, and severely weakening U.S. financial markets, the Administration on April 9th suspended its tariff increases for all countries, except for China, for 90 days. While most trading partners have refrained from taking their own retaliatory actions, China responded quickly with its own set of new trade duties.

Previously the U.S.’s number three trading partner with U.S. imports of $582 billion in 2024, China had tariffs raised on its goods by more than 5-fold from 25% to 145%. In reprisal, China raised its own tariffs on U.S. exports by 125%. On April 14th, and in a further show of strength, China went on the attack by suspending the exports of all rare earth minerals. Although annual production of these minerals is less than $4 billion, they are critical to the production of sophisticated manufactured goods by a broad swath of industries. With a 90% global share of processed rare earth minerals controlled by China, the impacted industries will not be able to readily find an alternative supply of these materials if this export ban were to be maintained.

As things stand today, the dollar has declined 5% from its pre- April 2nd levels as foreign and domestic investors have sold dollar-denominated assets in response to the Administration’s actions. After the announcement of the new trade tariffs and a surprise supply increase by OPEC+ pushed crude oil down by ~20% to a four-year low of $60/barrel, forecasters – from Wall Street banks to the U.S. government – downgraded their views on the economy for the remainder of 2025, all with sharply higher expectations for a recession this year.

As part of its own update, the Federal Reserve recently modified its economic forecast for the year – raising its inflation forecast to 2.8%, lowering projected GDP growth rate to 1.7%, and increasing its unemployment forecast to 4.4%. The Atlanta branch of the Fed took an even more conservative position calling for a 2.5% economic contraction in the year’s first quarter. Unfortunately, this sharp shift in economic projections has all been driven by the anticipated impact of the new global tariff order created by LD.

Tariffs, a tax on consumption of foreign goods, are by their very existence inflationary. As such, this action has clouded both the size and direction of future U.S. central bank interest rate action. Market expectations now stand at a 50% likelihood of 4 rate cuts totaling one percentage point before year-end. We, however, believe that these expectations are anchored on the belief that the Federal Reserve will aggressively cut interest rates to prevent a recession. Conversely, our belief is that the central bank will remain focused on the new inflationary pressures provoked by LD. On April 16th, Fed Chair Powell reiterated this very point – to the dismay of Wall Street which immediately declined and closed down 1.7%. With price increases currently running above the Fed’s desired 2.0% level, the new Chinese tariffs will only exacerbate the U.S.’s still above target inflation situation. If the briefly suspended global tariff increase is actually put in place, it will only further worsen the nation’s inflationary situation.

To date, Congress has taken no position on LD’s proposed structural change in the U.S.’s trade policy. Under Article 1, Section 8 of the U.S Constitution, the two chambers have the ultimate authority over tariffs although they have effectively delegated this authority to the President over recent decades. Instead, Congress has recently been focused on enacting the President’s desired sharp tax cuts. Distracted by the tariff situation, little attention has been paid to the enormous tax cut that the two houses have just approved.

Congress is now working to resolve the two bills’ differences before being presented to a White House eager for its signature. The House has taken a theoretically more conservative approach with only $2.5 trillion of net new tax cuts as compared to the Senate version which allows for as much as $4.0 trillion of tax reductions. Both bills belie common sense as during an economic expansion, the U.S. ran a $1.8 trillion annual deficit in 2024 – equal to a staggering 27% of total government spending.

Enacting a tax cut when the government is already running an enormous and rapidly growing structural tax deficit is, to be generous, foolhardy. We are not optimistic about the near to intermediate-term performance of the American economy given the current severe trade war with China along with the massive, and soon to further expand, federal budget deficit. Neither action bodes well for American economic strength in the decade’s latter half. We can only whistle in the wind that common sense somehow prevails on either, much less both, of these matters.

And markets respond terribly to the new world order…….

To the surprise of virtually no one, U.S. markets did not respond well to LD. Wall Street sold off dramatically as over $6 trillion in market value was destroyed over a two-day period. Prior to the president’s 90-day suspension of all non-Chinese tariff increases, Wall Street’s fear measure, the CBOE Volatility Index, had hit its highest level since March of 2020 – having tripled in a matter of days before abating appreciably following the delay in implementing most tariff increases.

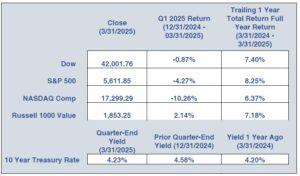

Going into 2025, there were concerns that equity markets were overvalued. The popular Shiller PE Ratio, a tool used to measure current stock valuations, was sitting at an all-time high entering the New Year as the famed Mag 7 drove the markets to all-time highs over the last two years. With this backdrop, paired with the uncertainty of a new Trump Administration, investors were already growing skeptical of Wall Street with the S&P 500 down almost 5% year-to-date before the new tariff announcement. Following LD, the index briefly entered into a bear market, down more than 21% from its 2025 highs, before recovering (following the April 6th suspension of most tariff increases) for a 10.0% decline through mid-April. Our preferred index, the Russell 1000 Value, fared appreciably better with a maximum decline of 12.1% and a year-to-date decline of less than 4.5%.

On the other side of the public markets, fixed income initially saw interest rates sharply decline after LD followed by a rapid increase as markets more fully digested the news. The interest rate bellwether, the 10-year US Treasury yield, briefly broke beneath 4.0% before climbing back to 4.4%. Short-term rates rallied even more as market participants priced in multiple Fed rate cuts in the immediate future – a position that we are very dubious of.

The risk to markets is that tariffs act more like a slow puncture rather than a pin bursting a bubble. Current analyst predictions are for S&P 500 earnings growth of 10.6% in 2025, according to FactSet, but only 7.3% for the first quarter. Hopes of accelerating U.S. economic growth for the remainder of the year are hard to reconcile with the sharply escalating tensions between the U.S. and China, the world’s two largest economies.

Looking ahead, we believe it to be especially crucial that you adhere to your current investment strategy. Notwithstanding this, higher than usual cash holdings could be appropriate given the increased market volatility and greater economic uncertainty. As a firm, we will continue to keep a close eye on the markets and pursue opportunities as they arise.

Please do not hesitate to reach out to us if there is an issue or concern that we can help you address. The entire Dumaine staff wishes everyone a wonderful Spring!