The Fed finally start reducing rates…

The long anticipated, and highly debated, initial interest rate cut by the Federal Reserve finally arrived. After the Fed’s mid-September meeting, Chair Jerome Powell announced a 50-basis point rate cut (bps or 0.50 percentage points) – the first rate cut in what is expected to be a succession of future cuts. Experts are predicting at least another 25-bps in cuts before the end of the year with another 100-bps in reduction by the end of 2025.

Until recently, a more aggressive set of Fed actions had been anticipated. However, economists were surprised to learn that 254,000 jobs were created in September – 100,000 more jobs than predicted. Further, the Department of Labor report revised the jobs data for the summer to reflect that 72,000 more positions were added to the economy than originally reported.

The Fed’s September decision to cut rates was largely influenced by the rise of unemployment as fears mounted that the economy was slowing and possibly heading toward a recession. In early October, these concerns were largely allayed with the release of the September jobs report, which had unemployment maintain its prior 4.1% level, not showing the additional predicted deterioration. Adding to this positive economic narrative, the latest GDP report was released in late September for the year’s second quarter showing a robust annual growth rate of 3.0%, effectively doubling the first quarter’s growth rate of 1.6%.

As a result, and from a macroeconomic viewpoint, the U.S. economy appears to be in a good position at this time. While national economic data appears solid, there are several major international conflicts that could derail the current feel-good economy. There are fears though for future global geopolitical stability as conflicts worsen in the Ukraine, the Palestine and the East China Sea/Taiwan – any of which could cause major harm to the American economy.

Tensions also continue to escalate in the US as the Presidential election fast approaches. Currently, the polls are predicting a tossup between the two candidates. Fears abound though regarding the policy and budgetary implications of a new Administration. Predictions are that either party would generate substantial additional deficits based upon their existing policy platforms. The proposed Trump tax measures would have a Republican administration expanding the national debt by an estimated $7.5 trillion, twice as much as the estimates for policies proposed by Democratic rival Harris.

In the meantime, jobs creation and economic growth appear solid. The remaining unknown is the future trajectory of inflation. The most recent consumer price index showed core inflation running at 3.3% as opposed to forecasts of 3.1%. While other data has been more favorable, fears remain that the battle against inflation has not yet to be won. From the beginning, many experts felt that the last mile of the inflation fight would be the hardest; in fact, this is proving to be true.

To simplify, the implications of the inflation battle not being fully won would be for interest rates to stay higher for longer to firmly re-anchor cost growth at reasonable levels. This expectation is already being predicted in the Fed CME Group’s Fed funds watch with the rate and timing of anticipated rate cuts being scaled back appreciably. However, with jobs creation remaining robust, unemployment at historically lower levels and recent strong economic growth, the focus for the time being is on the economic glass being more than half full.

As markets fall upward…

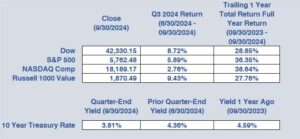

Despite an early August selloff, equity markets finished the quarter strong and continue to push to new highs. The S&P 500 is up 20%+ on the year while the Russell 1000 Value has produced gains of 15%+. All market sectors are up for the year with each area, except for energy, showing double-digit gains. The broadening of the market’s gains outside of the tech sector is a strong positive as now all corners of the market are now participating in the advance rather than Wall Street just being pulled up by a few very large companies.

With the markets’ recent strength though, it has made for a challenging time to be a stock buyer as a number of common valuation indicators are signaling record highs. One particular valuation tool, the CAPE Ratio, is a variation of the popular Price to Earnings ratio but it further adjusts for the full economic cycle. Currently, the CAPE ratio for the S&P 500 is at its third highest level since 1880, thereby insinuating, at a minimum, that this market is quite expensive relative to historic norms

Meanwhile, the fixed income markets have also proven to be active with a substantial shift in the yield curve. Since the Federal Reserve finished its cycle of rate increases with the overnight interest rate standing at 5.25%+, the yield curve has been inverted, i.e., where short-term interest rates were in the unusual position of being higher than that of longer-term bonds. With the initial large 50-bps point rate cut, and the anticipation of future cuts to the Fed Fund rate, the yield curve has begun to shift back to its more normal shape where longer term debt pays more interest than short term securities.

Looking ahead, we will be keeping a close watch on the Fed and how it chooses to continue its reductions in the Fed Fund rate before year-end. Originally projected to be cut by 125 basis points this year, and with a 50-bps cut at the last meeting, which would mean rates would need to see another 75-bps reduction over the next two meetings. Based on the recent, and unexpectedly robust, economic data, expectations for further cuts this year have scaled back to between 25-bps and 50-bps in additional cuts before year-end. Lastly, we will continue to keep close eyes on the various global geopolitical flashpoints along with the fast-approaching November presidential election. While there are worries as to what will happen to financial markets should one or the other candidate win, it is even more important to remain focused on the long term.

Looking over the last 100 years, equity and fixed income investments have historically provided investors with consistent inflation-adjusted positive returns. We urge you to continue with your current financial plan in both the current good times and future difficult times as well. If your personal situation has changed or there are additional personal matters, we should be made aware of, please do not hesitate to reach out and contact us. Wishing all of you a safe and cooler fall season.