Definitely higher for longer….

2024 began with the Federal Reserve signaling the likelihood of shortly commencing interest rate cuts. Most experts were predicting up to two percentage points of cuts for the year with more to follow in the ensuing years. Early volatility in economic data helped define the year with consecutive Consumer Price Index “CPI” reports exceeding expectations and a surprising March labor report significantly outpacing forecasts. This unexpected strength cast doubt on the likelihood of near-term rate cuts as investors began to believe the economy remained overheated. In response, there was a flight to cash, bond yields spiked, and markets experienced a brief pullback.

By the summer, inflation began to revert back to its downward trend, easing the Fed’s worries and allowing the central bankers to shift their attention to the labor market. Unemployment spiked to 4.3%, a significant increase from the year prior’s rate of 3.5%. These developments set the stage for Federal Reserve Chair Powell to announce the Fed’s initial rate cut—a surprising 50-basis-point reduction in September that caught many market participants off guard.

As the third quarter ended, however, economic reports began to reflect a hotter-than-expected economy. There was a decrease of the unemployment rate to 4.1% and a large, unexpected increase in new jobs added. Further, several inflation readings came in higher than expected. Experts started questioning the Fed’s decision to implement such an aggressive initial rate cut. This uncertainty led into the 2024 elections which ended up with decisive wins of the Congress and the White House by the Republican party.

Ultimately, the Fed cut rates two more times in the late Fall for an additional total of 50 basis points or one whole percentage point for the year. From a bird’s eye view, the U.S. economy is in largely a good place, especially when compared to peers. Current expectations are now for the Fed to cut rates no more than two more times in 2025 for a total of 50 basis points. Forecasts now place these cuts in the latter half of the year. Interest rates are now at historically normal levels and inflation, albeit stubbornly, continues a slow descent towards the Fed’s 2% target.

Economic growth, even in the face of higher interest rates, is anticipated to be around 2.5% for the full year 2024 – appreciably above almost all of America’s peers. With the economy performing unexpectedly well, the Fed has been able to shift its focus to the labor markets. As of January, unemployment hovers around the historical average of 4% with the December reading coming in at 4.1% with an unexpectedly strong 256,000 jobs added in the month, well above the 155,000 jobs that economists expected. 2025’s forecasted economic growth is currently anticipated to be roughly the same as 2024’s strong performance. At this stage, the central bank needs to be exceptionally careful not to cut rates too quickly. Additionally, markets must pare back their expectations for added sharp rate cuts and which have appreciably faded in recent weeks.

What can go wrong from here? The incoming Trump Administration is insisting that it will broadly increase tariffs on imported goods while also maintaining tax cuts that were supposed to expire at year-end 2025. If in fact carried out, both measures would prove to be inflationary – the very thing that the U.S. central bank has spent the last 2 years trying to rein in. And if implemented, these actions would further conflict the Fed as to what its next move needs to be, either decreasing or increasing rates. In any case, the recent sharp moves in the bond market suggest that 2025 could prove to be a potentially trying year. We will all have to wait and see.

As Wall Street shows remarkable strength……

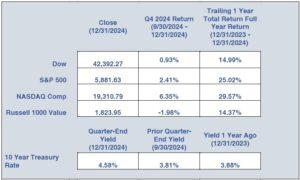

Investors entered 2024 focused on figuring out exactly when the Fed was going to pivot towards lower interest rates. Heightening the drama was a challenging presidential election with the two candidates who were presenting markedly different paths forward for the country. Despite these concerns, the markets had their second strong year in a row with the S&P 500 climbing by more than 20% in each year and with the more conservative Russell 1000 Value producing 10%+ returns in the same period.

Led by the Magnificent 7 tech stocks, the S&P 500 finished the year with a 25% gain as the Russell 1000 Value advanced a robust 14%. While the market can be viewed as concentrated, one bright spot is that ten of the eleven market sectors finished positive thereby bringing credence to the fact that the market’s rally has evolved outside of a handful of technology names.

However, there are increasing concerns that equity valuations may be reaching unsustainable levels. Metrics comparing fixed income levels to stock valuations suggest that stocks are approaching their most overvalued levels relative to bonds in over two decades. According to conventional financial theory, riskier stocks should provide a higher earnings yield than bonds, which are inherently safer.

The S&P 500 earnings yield now stands at 3.7% as compared to the 5.6% yield on low investment quality BBB-rated U.S. corporate bonds. This narrowing spread, the smallest since 2008, is a concerning signal. Historically, equity yields fall below bond yields only during periods of economic bubbles or heightened credit risk, as noted by Ven Ram – a strategist for Bloomberg Markets. This unusual dynamic raises serious questions about the sustainability of the equity market’s continued advances.

The concern for the markets, though, is that much of the recent rise in yields does not appear to reflect expectations of stronger economic growth. Rather, it appears to be the result of investors applying a higher discount or “term premium” to hold long-term bonds, estimates by the Federal Reserve suggest. Some analysts attribute this to the possibility of Donald Trump’s promised tariffs derailing the global economy and leading to a jump in inflation while his proposed tax cuts would further bloat already enormous budget deficits.

At present, most U.S. companies are prospering, and, by proxy, markets are performing well. Many Wall Street analysts are predicting double-digit returns again for the U.S.’s stock market this year. With the Fed now far less likely to cut rates as quickly as investors had hoped, corporate earnings growth have become even more critical to support continued market advances. As result, the just starting earnings season is going to be exceptionally vital. According to research firm Factset, earnings growth of 12.0% is projected – this would be the biggest quarterly profit increase since 2021, although down from expectation of 14.5% growth in September.

While the market fundamentals may look stretched, and with or without strong help from corporate earnings, the “animal spirits” can carry the markets for quite a while before subsiding. All of this is to say, maintaining an appropriate asset allocation aligned with your long-term plans and goals remains crucial, especially in navigating today’s very uncertain economic environment.

In the meantime though, we wanted to wish all of you a very happy and safe New Year! As always, please reach out to us if there are any concerns or issues that we can be of help.